Nokia 2003 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2003 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Consolidated Financial Statements (Continued)

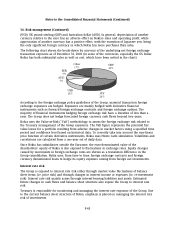

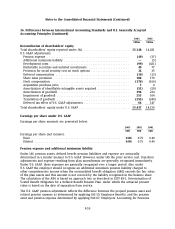

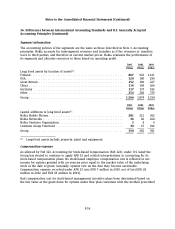

36. Differences between International Accounting Standards and U.S. Generally Accepted

Accounting Principles (Continued)

over its estimated useful life. The adjustment to U.S. GAAP net income and shareholders’ equity

relates to the amortization and accumulated amortization, respectively, of Amber Networks’

intangible asset.

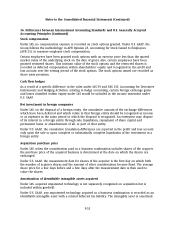

The gross carrying amount of unpatented technology recorded as identifiable intangible assets,

under U.S. GAAP, is EUR 109 million as of December 31, 2003 (EUR 109 million as of December 31,

2002), which is being amortized over an estimated useful life of five years. Accumulated

amortization as of December 31, 2003 was EUR 51 million (EUR 29 million at December 31, 2002).

The amortization expense for the year ended December 31, 2003 is EUR 22 million (EUR 22 million

and EUR 7 million in 2002 and 2001, respectively).

Amortization expense on intangible assets is expected to be EUR 22 million in 2004 and 2005 and

EUR 14 million in 2006.

The net carrying amount of other intangible assets under U.S. GAAP is EUR 623 million in 2003

and consists of capitalized development costs of EUR 438 million and acquired patents, trademarks

and licenses of EUR 185 million. The Group does not have indefinite lived intangible assets. The

amortization expense under U.S. GAAP of other intangible assets subject to amortization as of

December 31, 2003, is expected to be approximately EUR 167 million for each of the next five

years.

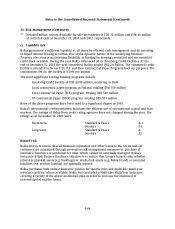

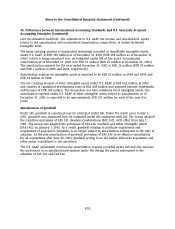

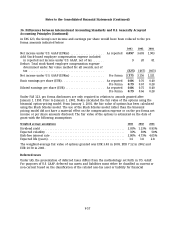

Amortization of goodwill

Under IAS, goodwill is amortized over its estimated useful life. Under U.S. GAAP, prior to July 1,

2001, goodwill was amortized over its estimated useful life consistent with IAS. The Group adopted

the transition provisions of FAS 141, Business Combinations (FAS 141), with effect from July 1,

2001. The Group also adopted the provisions of FAS 142, Goodwill and Other Intangible Assets

(FAS 142), on January 1, 2002. As a result, goodwill relating to purchase acquisitions and

acquisitions of associated companies is no longer subject to amortization subsequent to the date of

adoption. As the non-amortization of goodwill provisions of FAS 142 were effective immediately

for all acquisitions after June 30, 2001, goodwill arising from the Amber Networks acquisition and

other minor acquisitions is not amortized.

The U.S. GAAP adjustment reverses the amortization expense recorded under IAS and also reverses

the movement in accumulated amortization under IAS during the period subsequent to the

adoption of FAS 141 and FAS 142.

F-53