Nokia 2003 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2003 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements (Continued)

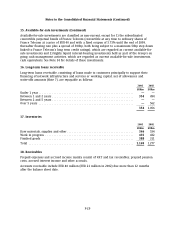

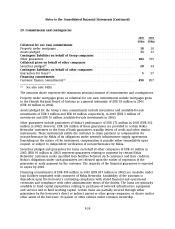

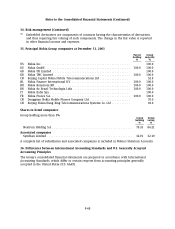

27. Provisions

IPR

Warranty infringements Other Total

EURm EURm EURm EURm

At January 1, 2003 ................................ 1,603 273 594 2,470

Exchange differences ............................... (36) — — (36)

Additional provisions .............................. 683 119 300 1,102

Change in fair value ............................... — — (22) (22)

Unused amounts reversed .......................... (286) — (28) (314)

Charged to profit and loss account .................... 397 119 250 766

Utilized during year ............................... (661) (21) (96) (778)

At December 31, 2003 .............................. 1,303 371 748 2,422

2003 2002

EURm EURm

Analysis of total provisions at December 31:

Non-current .......................................................... 593 460

Current ............................................................. 1,829 2,010

The IPR provision is based on estimated future settlements for asserted and unasserted past IPR

infringements. Final resolution of IPR claims generally occurs over several periods. This results in

varying usage of the provision year to year.

Other provisions mainly include provisions for non-cancelable purchase commitments, tax

provisions and a provision for social security costs on stock options.

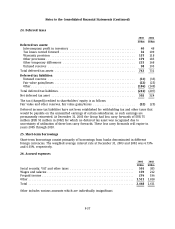

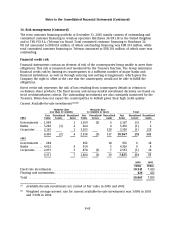

28. Earnings per share

2003 2002 2001

Numerator/EURm

Basic/Diluted:

Net profit ........................................ 3,592 3,381 2,200

Denominator/1000 shares

Basic:

Weighted average shares ........................... 4,761,121 4,751,110 4,702,852

Effect of dilutive securities:

stock options ................................... 40 36,932 84,367

Diluted:

Adjusted weighted average shares and assumed

conversions .................................... 4,761,161 4,788,042 4,787,219

Under IAS 33, basic earnings per share is computed using the weighted average number of shares

outstanding during the period. Diluted earnings per share is computed using the weighted average

number of shares outstanding during the period plus the dilutive effect of stock options

outstanding during the period.

F-38