Nokia 2003 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2003 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements (Continued)

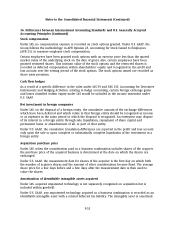

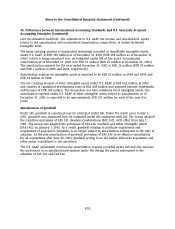

36. Differences between International Accounting Standards and U.S. Generally Accepted

Accounting Principles (Continued)

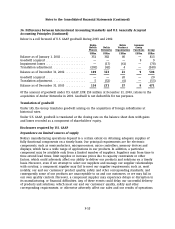

reporting. This table presents the IAS deferred tax assets and liabilities according to the

presentation prescribed by FAS 109, Accounting for Income Taxes under U.S. GAAP.

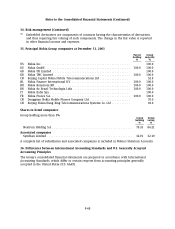

2003 2002

EURm EURm

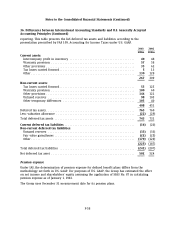

Current assets:

Intercompany profit in inventory ....................................... 40 48

Warranty provision .................................................. 57 58

Other provisions ..................................................... 35 62

Tax losses carried forward ............................................. 513

Other .............................................................. 130 128

267 309

Non-current assets:

Tax losses carried forward ............................................. 53 125

Warranty provision .................................................. 100 60

Other provisions ..................................................... 144 121

Untaxed reserves .................................................... 98 105

Other temporary differences ........................................... 103 40

498 451

Deferred tax assets ..................................................... 765 760

Less: valuation allowance ............................................... (22) (29)

Total deferred tax assets ................................................ 743 731

Current deferred tax liabilities .......................................... (16) (20)

Non-current deferred tax liabilities:

Untaxed reserves .................................................... (33) (33)

Fair value gains/losses ................................................ (22) (25)

Other .............................................................. (170) (129)

(225) (187)

Total deferred tax liabilities ............................................. (241) (207)

Net deferred tax asset .................................................. 502 524

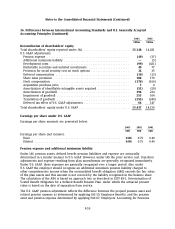

Pension expense

Under IAS, the determination of pension expense for defined benefit plans differs from the

methodology set forth in U.S. GAAP. For purposes of U.S. GAAP, the Group has estimated the effect

on net income and shareholders’ equity assuming the application of SFAS No. 87 in calculating

pension expense as of January 1, 1992.

The Group uses December 31 measurement date for its pension plans.

F-58