Nokia 2003 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2003 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Restricted Shares to recruit, retain, reward and motivate selected high potential and critical

employees. In 2004, the maximum number of Restricted Shares to be granted is 2 million.

The maximum number of shares and/or options to be granted under the 2004 Equity Program is

26 million, or approximately 0.6 per cent of all outstanding shares.

Administration of the Program

Following the approval of the program by the Board of Directors, the Personnel Committee will

administer the program according to its charter, including the determination of the principles

under which grants will be made. The Board of Directors will approve the grants to the CEO and

the President.

ITEM 7. MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS

7.A Major Shareholders

No persons are known by Nokia to hold currently more than 5% of the voting securities of Nokia

Corporation. As far as we know, Nokia is not directly or indirectly owned or controlled by another

corporation or by any government, and there are no arrangements that may result in a change of

control of Nokia. During the past three years, the only shareholder we have known to hold 5% of

our voting securities has been Janus Capital Corporation, which informed us on December 9, 1999

that its holdings of Nokia shares exceeded 5% of our total share capital. Janus Capital Corporation

informed us on July 26, 2001 that its ownership position had decreased below 5% of our total

share capital. Its address is 100 Fillmore Street, Denver, Colorado, 80206-4923, United States.

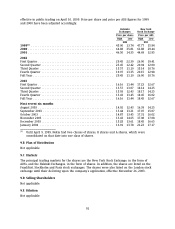

As at December 31, 2003, 1 213 157 321 ADSs (equivalent to the same number of shares or

approximately 25.3% of the total outstanding shares) were outstanding and held of record by

22 005 registered holders in the United States. We are aware that many ADSs are held of record

by brokers and other nominees, and accordingly the above numbers are not necessarily

representative of the actual number of persons who are beneficial holders of ADSs or the number

of ADSs beneficially held by such persons. Based on information available from Automatic Data

Processing, Inc. (‘‘ADP’’). the number of beneficial owners of ADSs as of December 31, 2003 was

approximately 1.4 million.

As at December 31, 2003, there were approximately 133 991 holders of record of our shares. Of

these holders, around 658 had registered addresses in the United States and held a total of some

6 927 183 of our shares, approximately 0.14% of the total outstanding shares. In addition, certain

accounts of record with registered addresses other than in the United States hold our shares, in

whole or in part, beneficially for United States persons.

7.B Related Party Transactions

There have been no material transactions during the last three fiscal years to which any director,

executive officer or 5% shareholder, or any relative or spouse of any of them, was a party. There

is no significant outstanding indebtedness owed to Nokia by any director, executive officer or 5%

shareholder.

There are no material transactions with enterprises controlling, controlled by or under common

control with Nokia or associate of Nokia.

See Notes 31 and 32 to our consolidated financial statements included in Item 18 of this

Form 20-F.

7.C Interests of Experts and Counsel

Not applicable.

88