Nokia 2003 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2003 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements (Continued)

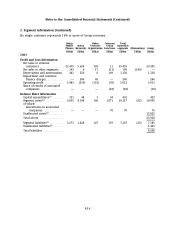

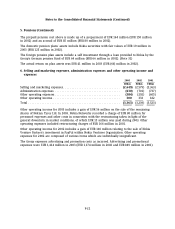

5. Pensions (Continued)

The prepaid pension cost above is made up of a prepayment of EUR 164 million (EUR 150 million

in 2002) and an accrual of EUR 85 million (EUR 80 million in 2002).

The domestic pension plans’ assets include Nokia securities with fair values of EUR 19 million in

2003 (EUR 125 million in 2002).

The foreign pension plan assets include a self investment through a loan provided to Nokia by the

Group’s German pension fund of EUR 64 million (EUR 66 million in 2002). (Note 31)

The actual return on plan assets was EUR 41 million in 2003 (EUR (66) million in 2002).

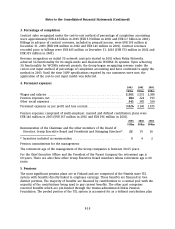

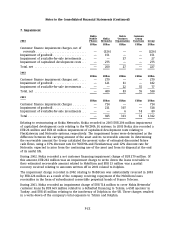

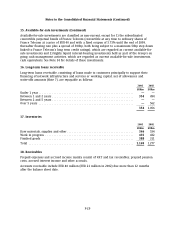

6. Selling and marketing expenses, administration expenses and other operating income and

expenses

2003 2002 2001

EURm EURm EURm

Selling and marketing expenses .................................. (2,649) (2,579) (2,363)

Administration expenses ....................................... (630) (701) (737)

Other operating expenses ....................................... (384) (292) (605)

Other operating income ........................................ 300 333 182

Total ....................................................... (3,363) (3,239) (3,523)

Other operating income for 2003 includes a gain of EUR 56 million on the sale of the remaining

shares of Nokian Tyres Ltd. In 2003, Nokia Networks recorded a charge of EUR 80 million for

personnel expenses and other costs in connection with the restructuring taken in light of the

general downturn in market conditions, of which EUR 15 million was paid during 2003. Other

operating expenses included restructuring charges of EUR 166 million in 2001.

Other operating income for 2002 includes a gain of EUR 106 million relating to the sale of Nokia

Venture Partner’s investment in PayPal within Nokia Ventures Organization. Other operating

expenses for 2002 are composed of various items which are individually insignificant.

The Group expenses advertising and promotion costs as incurred. Advertising and promotional

expenses were EUR 1,414 million in 2003 (EUR 1,174 million in 2002 and EUR 849 million in 2001).

F-21