Nokia 2003 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2003 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.During 2003, the mobile networks market declined by just over 15% in euro terms, according to

Nokia’s preliminary estimates, while network operators continued to focus on short-term cash

flow generation and debt reduction. Although 2003 marked the third consecutive year of decline

in the mobile networks market, encouraging signs in the fourth quarter indicated that the market

began to stabilize as the financial position of network operators improved. As well, during the

second half of 2003, operators began to reconfirm their commitment to 3G WCDMA, most notably

by renewing or continuing their network equipment supply agreements, and by accelerating the

deployment of the networks compared to 2002.

By the end of 2003, Nokia was a supplier to six of the world’s 12 commercially launched 3G

WCDMA networks and was rolling out 26 3G WCDMA networks in 15 countries. Altogether, Nokia

has 37 publicly announced 3G WCDMA deals.

In 2003, Nokia announced 18 GSM, GPRS or GSM/GPRS/EDGE deals in various parts of the world, in

addition to four EDGE deals in Latin America and Asia-Pacific. EDGE gained momentum during the

year and at year-end, Nokia was a supplier to nine of the 11 commercially launched EDGE

networks. This included a nationwide EDGE deployment and network opening with AT&T Wireless

in the United States.

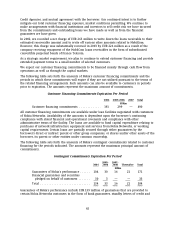

In 2003, Nokia Networks took action to improve profitability, by ceasing certain ongoing research

and development projects and reducing the number of its employees. Nokia Networks research

and development costs totaled EUR 1 540 million in 2003 (27.4% of Nokia Networks’ net sales).

These include restructuring costs of EUR 15 million relating to personnel reduction, impairments

(EUR 275 million) and write-offs (EUR 180 million) of capitalized R&D costs, totaling

EUR 470 million. In 2002, Nokia Networks R&D costs were EUR 995 million (15.2% of Nokia

Networks net sales). If the restructuring costs, impairments and write-offs were excluded, R&D

expenses would have been 19.0% of net sales in 2003, representing growth in R&D expenses of 8%

compared with 2002.

Selling and marketing expenses in Nokia Networks were EUR 476 million in 2003 (8.5% of Nokia

Networks net sales), compared to EUR 640 million (9.8% of Nokia Networks net sales) in 2002.

Nokia Networks operating loss increased to EUR 219 million in 2003 compared to an operating loss

of EUR 49 million in 2002. Nokia Networks operating margin was negative at (3.9)% in 2003 and

(0.7)% in 2002. In 2003, Nokia Networks operating loss included the aforementioned

EUR 470 million in restructuring costs, impairments and write-offs related to R&D, and, in

addition, restructuring costs in other functions of EUR 80 million. The operating loss in 2003 also

included a goodwill impairment of EUR 151 million in Nokia Networks’ Core Networks business in

connection with Amber Networks. This impairment was due to the negative future market outlook

and the decision to discontinue some of the related development projects. We have evaluated the

carrying value of goodwill arising from Amber Networks acquisition to determine if the carrying

value exceeds recoverable amounts. The impairment was calculated by comparing the discounted

cash flows of the relevant business to the carrying value of assets for this business. In addition,

Nokia Networks operating loss included a positive adjustment of EUR 226 million related to the

customer finance impairment in 2002 related to MobilCom. For a further discussion of the

MobilCom loans, see ‘‘Item 5.B Liquidity and Capital Resources—Customer Financing’’ and Notes 7

and 15 to our consolidated financial statements.’’

Nokia Ventures Organization—Net sales from Nokia Ventures Organization totaled EUR 366 million

in 2003 compared to EUR 459 million in 2002. Nokia Ventures Organization reported operating

losses of EUR 161 million in 2003 compared to EUR 141 million in 2002. Operating results included

a net loss of EUR 27 million from Nokia Venture Partners investments mainly resulting from the

impairment of certain investments. In the first half of 2003, revenue at Nokia Internet

Communications continued to be affected by the slowdown in information technology spending.

54