Nokia 2003 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2003 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements (Continued)

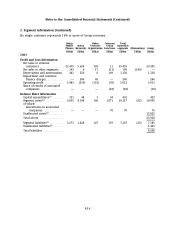

5. Pensions (Continued)

and the reserved portion as a defined benefit plan. The foreign plans include both defined

contribution and defined benefit plans.

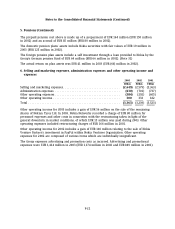

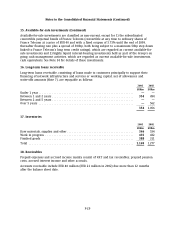

The amounts recognized in the balance sheet relating to single employer defined benefit schemes

are as follows:

2003 2002

Domestic Foreign Domestic Foreign

Plans Plans Plans Plans

EURm EURm EURmEURm

Fair value of plan assets ................................ 683 204 636 126

Present value of funded obligations ....................... (666) (343) (539) (261)

Surplus/(Deficit) ....................................... 17 (139) 97 (135)

Unrecognized net actuarial (gains)/losses ................... 140 61 45 63

Prepaid/(Accrued) pension cost in balance sheet ............. 157 (78) 142 (72)

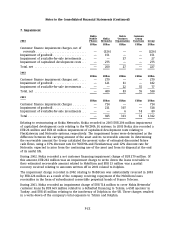

The amounts recognized in the profit and loss account are as follows:

2003 2002 2001

EURm EURm EURm

Current service cost .............................................. 54 58 49

Interest cost .................................................... 46 47 40

Expected return on plan assets ..................................... (55) (61) (75)

Net actuarial losses (gains) recognized in year ......................... 32 (16)

Past service cost ................................................. —11 —

Curtailment .................................................... (10) — (1)

Total, included in personnel expenses ................................ 38 57 (3)

Movements in prepaid pension costs recognized in the balance sheet are as follows:

2003 2002

EURm EURm

Prepaid pension costs at beginning of year .................................. 70 73

Net income (expense) recognized in the profit and loss account ................. (38) (57)

Contributions paid ..................................................... 47 54

Prepaid pension costs at end of year ....................................... 79* 70*

* Included within prepaid expenses and accrued income.

The principal actuarial weighted average assumptions used were as follows:

2003 2002

Domestic Foreign Domestic Foreign

%%%%

Discount rate for determining present values ............. 5.25 5.30 5.50 5.58

Expected long term rate of return on plan assets .......... 6.00 6.87 7.25 6.56

Annual rate of increase in future compensation levels ...... 3.50 3.49 3.50 3.09

Pension increases ................................... 2.30 2.27 2.30 2.29

F-20