Nokia 2003 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2003 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.During the second half of 2003 the market began to show signs of improvement. Enterprises

continued to rank spending on corporate network security as among their highest priorities, with

positive effects on overall market growth in 2003. Sales at Nokia Internet Communications were

slightly lower in 2003, reflecting the continued weakness of the US dollar. During 2003, Nokia

Home Communications continued renewing and broadening its product portfolio. However, the

market for digital set top boxes developed slower than expected leading in decrease in sales

compared to 2002.

Common Group Expenses—This line item, which comprises Nokia Head Office, Nokia Research

Center and other general functions’ operating losses, totaled EUR 92 million in 2003, compared to

EUR 231 million in 2002. In 2003, this included a gain of EUR 56 million from the sale of the

remaining shares of Nokian Tyres. During 2002, the company’s investment in certain equity

securities suffered a permanent decline in value resulting in an impairment of available-for-sale

investments of EUR 55 million.

Net Financial Income

Net interest and other financial income totaled EUR 352 million in 2003 compared to

EUR 156 million in 2002. Net financial income in 2003 resulted from a continued strong cash

position reflected in the negative net debt to equity ratio of -71% at December 31, 2003, compared

to a net debt to equity ratio of -61% at December 31, 2002. See ‘‘—Exchange Rates’’ below. At

year-end 2003, we had cash and cash equivalents of EUR 11 296 million compared to EUR 9

351 million at year-end 2002.

Profit Before Taxes

Profit before taxes and minority interests increased 9% and totaled EUR 5 345 million in 2003

compared to EUR 4 917 million in 2002. Taxes amounted to EUR 1 699 million and

EUR 1 484 million in 2003 and 2002, respectively.

Minority Interests

Minority shareholders’ interest in our subsidiaries’ profits totaled EUR 54 million in 2003 compared

to EUR 52 million in 2002.

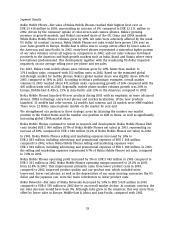

Net Profit and Earnings per Share

Net profit in 2003 increased to EUR 3 592 million, compared to EUR 3 381 million in 2002,

representing a year-on-year increase in net profit of 6% in 2003. Basic earnings per share

increased to EUR 0.75 in 2003 compared to EUR 0.71 in 2002.

2002 compared to 2001

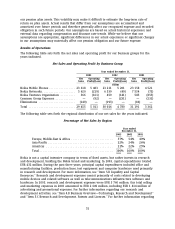

Nokia Net Sales and Operating Profit

The year 2002 was characterized by intense competition and a continued weakened global

economy. Our net sales totaled EUR 30 016 million in 2002 and EUR 31 191 million in 2001,

representing a decrease in net sales of 4% in 2002. This mainly reflected continuing difficult

operating conditions in our network infrastructure business. Our gross margin in 2002 improved

to 39.1% compared to 36.6% in 2001, reflecting primarily a decrease in product costs in Nokia

Mobile Phones. Our operating profit increased by 42% to EUR 4 780 million in 2002, compared to

EUR 3 362 million in 2001. Our operating margin was 15.9% in 2002, compared to 10.8% in 2001.

We continued to invest significantly in research and development. Research and development

expenses totaled EUR 3 052 million in 2002, an increase of 2% from 2001 (EUR 2 985 million).

Research and development expenses represented 10.2% of net sales in 2002 compared to 9.6% of

net sales in 2001.

55