Nokia 2003 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2003 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Consolidated Financial Statements (Continued)

1. Accounting principles (Continued)

For qualifying foreign exchange forwards the change in fair value is deferred in shareholders’

equity to the extent that the hedge is effective. For qualifying foreign exchange options the change

in intrinsic value is deferred in shareholders’ equity to the extent that the hedge is effective.

Changes in the time value are at all times taken directly as adjustments to sales or to cost of sales

in the profit and loss account.

Accumulated fair value changes from qualifying hedges are released from shareholders’ equity

into the profit and loss account as adjustments to sales and cost of sales, in the period when the

hedged cash flow affects the profit and loss account. If the hedged cash flow is no longer expected

to take place, all deferred gains or losses are released into the profit and loss account as

adjustments to sales and cost of sales, immediately. If the hedged cash flow ceases to be highly

probable, but is still expected to take place, accumulated gains and losses remain in equity until

the hedged cash flow affects the profit and loss account.

Changes in the fair value of any derivative instruments that do not qualify for hedge accounting

under IAS 39 are recognized immediately in the profit and loss account. The fair value changes of

derivative instruments that directly relate to sales and purchases are recognized as adjustments to

sales and cost of sales respectively. The fair value changes from all other derivative instruments

are recognized in financial income and expenses.

Foreign currency hedging of net investments

The Group also applies hedge accounting for its foreign currency hedging on net investments.

Qualifying hedges are those properly documented hedges of the foreign exchange rate risk of

foreign currency-denominated net investments that meet the requirements set out in IAS 39. The

hedge must be effective both prospectively and retrospectively.

The Group claims hedge accounting in respect of forward foreign exchange contracts, foreign

currency-denominated loans, and options, or option strategies, which have zero net premium or a

net premium paid, and where the terms of the bought and sold options within a collar or zero

premium structure are the same.

For qualifying foreign exchange forwards the change in fair value that reflects the change in spot

exchange rates is deferred in shareholders’ equity. The change in fair value that reflects the

change in forward exchange rates less the change in spot exchange rates is recognized in the

profit and loss account. For qualifying foreign exchange options the change in intrinsic value is

deferred in shareholders’ equity. Changes in the time value are at all times taken directly to the

profit and loss account. If a foreign currency-denominated loan is used as a hedge, all foreign

exchange gains and losses arising from the transaction are recognized in shareholders’ equity.

Accumulated fair value changes from qualifying hedges are released from shareholders’ equity

into the profit and loss account only if the legal entity in the given country is sold or liquidated.

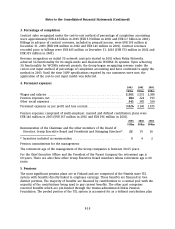

Revenue recognition

Sales from the majority of the Group are recognized when persuasive evidence of an arrangement

exists, delivery has occurred, the fee is fixed and determinable and collectibility is probable. The

remainder of the sales is recorded under the percentage of completion method.

F-10