Nokia 2003 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2003 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Consolidated Financial Statements (Continued)

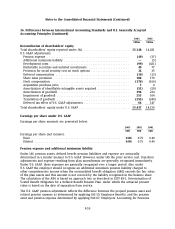

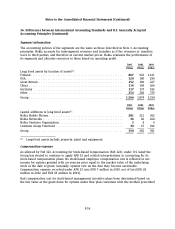

36. Differences between International Accounting Standards and U.S. Generally Accepted

Accounting Principles (Continued)

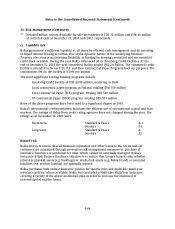

Stock compensation

Under IAS, no compensation expense is recorded on stock options granted. Under U.S. GAAP, the

Group follows the methodology in APB Opinion 25, Accounting for Stock Issued to Employees

(APB 25), to measure employee stock compensation.

Certain employees have been granted stock options with an exercise price less than the quoted

market value of the underlying stock on the date of grant. Also, certain employees have been

granted restricted shares. This intrinsic value of the stock options and the restricted shares is

recorded as deferred compensation within shareholders’ equity and recognized in the profit and

loss account over the vesting period of the stock options. The stock options issued are recorded as

share issue premium.

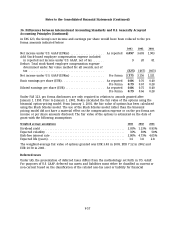

Cash flow hedges

As a result of a specific difference in the rules under IAS 39 and FAS 133, Accounting for Derivative

Instruments and Hedging Activities, relating to hedge accounting, certain foreign exchange gains

and losses classified within equity under IAS would be included in the income statement under

U.S. GAAP.

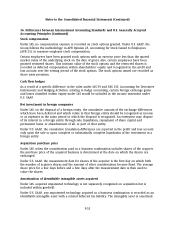

Net investment in foreign companies

Under IAS, on the disposal of a foreign entity, the cumulative amount of the exchange differences

which have been deferred and which relate to that foreign entity should be recognized as income

or as expenses in the same period in which the disposal is recognized. An enterprise may dispose

of its interest in a foreign entity through sale, liquidation, repayment of share capital and

permanent loans, or abandonment of all, or part of, that entity.

Under U.S. GAAP, the cumulative translation differences are reported in the profit and loss account

only upon the sale or upon complete or substantially complete liquidation of the investment in a

foreign entity.

Acquisition purchase price

Under IAS, when the consideration paid in a business combination includes shares of the acquirer,

the purchase price of the acquired business is determined at the date on which the shares are

exchanged.

Under U.S. GAAP, the measurement date for shares of the acquirer is the first day on which both

the number of acquirer shares and the amount of other considerations become fixed. The average

share price for a few days before and a few days after the measurement date is then used to

value the shares.

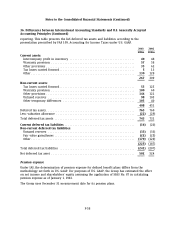

Amortization of identifiable intangible assets acquired

Under IAS, acquired unpatented technology is not separately recognized on acquisition but is

included within goodwill.

Under U.S. GAAP, any unpatented technology acquired in a business combination is recorded as an

identifiable intangible asset with a related deferred tax liability. The intangible asset is amortized

F-52