Nokia 2003 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2003 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

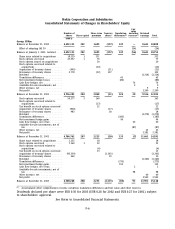

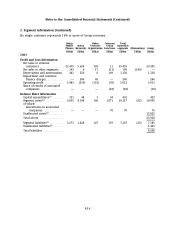

Nokia Corporation and Subsidiaries

Consolidated Statements of Changes in Shareholders’ Equity

Fair

value

Number of Share issue Treasury Translation and other Retained

shares Share capital premium shares differences(1) reserves(1) earnings Total

(000’s)

Group, EURm

Balance at December 31, 2000 ........ 4,692,133 282 1,695 (157) 347 — 8,641 10,808

Effect of adopting IAS 39 .......... (56) (56)

Balance at January 1, 2001, restated .... 4,692,133 282 1,695 (157) 347 (56) 8,641 10,752

Share issue related to acquisitions .... 18,329 1 331 332

Stock options exercised ........... 23,057 1 76 77

Stock options issued on acquisitions . . 20 20

Stock options exercised related to

acquisitions .................. (10) (10)

Acquisition of treasury shares ....... (995) (21) (21)

Reissuance of treasury shares ....... 3,778 (52) 157 105

Dividend ..................... (1,314) (1,314)

Translation differences ............ 65 65

Net investment hedge losses ........ (86) (86)

Cash flow hedges, net ............ 76 76

Available-for-sale investments, net .... 0 0

Other increase, net .............. 99

Net profit ..................... 2,200 2,200

Balance at December 31, 2001 ........ 4,736,302 284 2,060 (21) 326 20 9,536 12,205

Stock options exercised ........... 50,377 3 160 163

Stock options exercised related to

acquisitions .................. (17) (17)

Tax benefit on stock options exercised . 22 22

Acquisition of treasury shares ....... (900) (17) (17)

Reissuance of treasury shares ....... 983 18 18

Dividend ..................... (1,279) (1,279)

Translation differences ............ (285) (285)

Net investment hedge gains ........ 94 94

Cash flow hedges, net of tax ........ 60 60

Available-for-sale investments, net of

tax........................ (87) (87)

Other increase, net .............. 23 23

Net profit ..................... 3,381 3,381

Balance at December 31, 2002 ........ 4,786,762 287 2,225 (20) 135 (7) 11,661 14,281

Share issue related to acquisitions .... 1,225 18 18

Stock options exercised ........... 7,160 1 22 23

Stock options exercised related to

acquisitions .................. (6) (6)

Tax benefit on stock options exercised . 13 13

Acquisition of treasury shares ....... (95,339) (1,363) (1,363)

Reissuance of treasury shares ....... 460 10 10

Dividend ..................... (1,340) (1,340)

Translation differences ............ (375) (375)

Net investment hedge gains ........ 155 155

Cash flow hedges, net of tax ........ 2 2

Available-for-sale investments, net of

tax........................ 98 98

Other increase, net .............. 40 40

Net profit ..................... 3,592 3,592

Balance at December 31, 2003 ........ 4,700,268 288 2,272 (1,373) (85) 93 13,953 15,148

(1) Accumulated other comprehensive income comprises translation differences and fair value and other reserves.

Dividends declared per share were EUR 0.30 for 2003 (EUR 0.28 for 2002 and EUR 0.27 for 2001), subject

to shareholders’ approval.

See Notes to Consolidated Financial Statements.

F-6