Nokia 2003 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2003 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements (Continued)

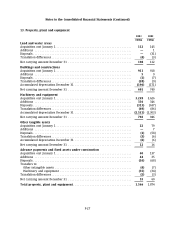

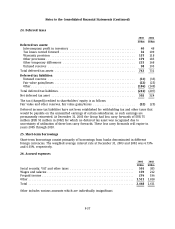

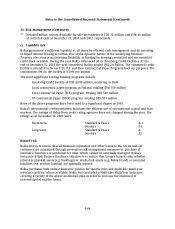

24. Deferred taxes

2003 2002

EURm EURm

Deferred tax assets:

Intercompany profit in inventory ....................................... 40 48

Tax losses carried forward ............................................. 36 109

Warranty provision .................................................. 157 118

Other provisions ..................................................... 179 183

Other temporary differences ........................................... 233 168

Untaxed reserves .................................................... 98 105

Total deferred tax assets ................................................ 743 731

Deferred tax liabilities:

Untaxed reserves .................................................... (33) (33)

Fair value gains/losses ................................................ (22) (25)

Other .............................................................. (186) (149)

Total deferred tax liabilities .............................................. (241) (207)

Net deferred tax asset .................................................. 502 524

The tax (charged)/credited to shareholders’ equity is as follows:

Fair value and other reserves, fair value gains/losses ......................... (22) (25)

Deferred income tax liabilities have not been established for withholding tax and other taxes that

would be payable on the unremitted earnings of certain subsidiaries, as such earnings are

permanently reinvested. At December 31, 2003 the Group had loss carry forwards of EUR 75

million (EUR 91 million in 2002) for which no deferred tax asset was recognized due to

uncertainty of utilization of these loss carry forwards. These loss carry forwards will expire in

years 2005 through 2010.

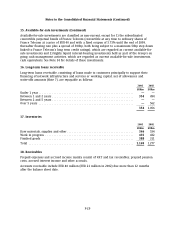

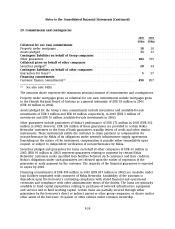

25. Short-term borrowings

Short-term borrowings consist primarily of borrowings from banks denominated in different

foreign currencies. The weighted average interest rate at December 31, 2003 and 2002 was 6.73%

and 6.01%, respectively.

26. Accrued expenses

2003 2002

EURm EURm

Social security, VAT and other taxes ...................................... 501 385

Wages and salaries .................................................... 170 212

Prepaid income ....................................................... 276 196

Other ............................................................... 1,521 1,818

Total ............................................................... 2,468 2,611

Other includes various amounts which are individually insignificant.

F-37