Nokia 2003 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2003 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements (Continued)

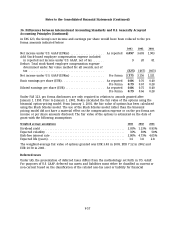

36. Differences between International Accounting Standards and U.S. Generally Accepted

Accounting Principles (Continued)

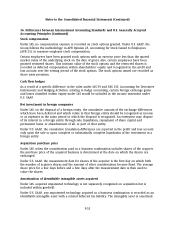

Weighted average assumptions used in calculation of the Domestic plans’ net periodic benefit cost

for years ending December 31 are as follows:

2003 2002

Domestic Domestic

%%

Discount rate for determining present values ............................ 5.50 5.80

Expected long term rate of return on plan assets ........................ 7.25 7.50

Annual rate of increase in future compensation levels .................... 3.50 4.00

Pension increases .................................................. 2.30 2.80

The assumption for weighted average expected return on plan assets is based on the target asset

allocation at the beginning of the year. The expected returns for the various asset classes are

based on 1) a general inflation expectation and 2) asset class specific long-term historical real

returns, which are assumed to be indicative of future expectations without requiring further

adjustments.

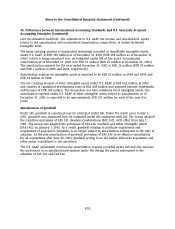

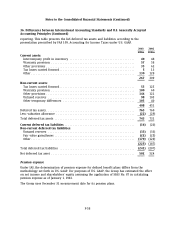

Foreign currency translation

Net foreign exchange gains/(losses) of EUR 182 million, EUR (63) million and EUR (256) million

were included in the determination of net income of which EUR (717) million, EUR (476) million

and EUR (309) million were included in cost of sales for the year ended December 31, 2003, 2002,

and 2001, respectively. EUR 867 million, EUR 442 million and EUR 78 million of the net foreign

exchange gains/(losses) were included in the determination of net sales in 2003, 2002 and 2001,

respectively.

Cash and cash equivalents

Under U.S. GAAP bank overdrafts of EUR 119 million and EUR 78 million in 2003 and 2002,

respectively, for which there is a legal right of offset would be included within cash and cash

equivalents and would be excluded from short-term borrowings, which has been reflected in total

U.S. GAAP assets in Item 3 of the Form 20-F.

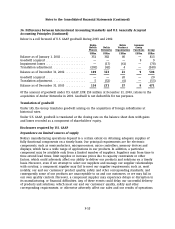

Consolidation

In 2002 Nokia had an investment in a subsidiary in which it owned 50% of the voting shares, and

was consolidated under IAS as Nokia has control of its operating and financial policies. In 2002

under US GAAP this entity would have been accounted for as a joint venture using the equity

method. The impact of deconsolidation would have increased net sales by approximately 4% and

would have had an immaterial effect on operating profit after adjusting for the impact of sales

from Nokia to the subsidiary and the subsidiary’s sales to Nokia. In addition, there would have

been no impact on net profit as a result of the deconsolidation. In 2003 the ownership of the

subsidiary was increased to 52.9% and the subsidiary is consolidated under both IAS and U.S.

GAAP. The application of FASB Interpretation No. 46, Consolidation of Variable Interest Entities,

(FIN 46), would have had a similar effect on the consolidation as the increase in ownership.

F-62