Nokia 2003 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2003 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.included office and manufacturing facilities, production lines, test equipment and computer

hardware used primarily in research and development.

Net cash used in financing activities increased to EUR 2 780 million in 2003, compared to

EUR 1 580 million in 2002, primarily as a result of the purchase of treasury shares with

EUR 1 355 million. Net cash used in financing activities decreased to EUR 1 580 million in 2002

compared to EUR 1 895 million in 2001, primarily as a result of decreases in repayment of

short-term borrowings and higher proceeds from stock option exercises.

At December 31, 2003, Nokia had EUR 20 million in long-term interest-bearing liabilities and

EUR 471 million in short-term borrowings, offset by EUR 11 296 million in cash and bank deposits

and current available-for-sale investments, resulting in a net cash balance of EUR 10 805 million,

compared to EUR 8 787 million at the end of 2002. In addition we hold EUR 816 million of

subordinated convertible perpetual bonds of France Telecom not included in cash and cash

equivalents. We are not unconditionally permitted to sell these bonds until the end of June 2004.

For further information regarding our long-term liabilities, including interest rate structure and

currency mix, see Note 23 to our consolidated financial statements included in Item 18 of this

Form 20-F. Our ratio of net interest-bearing debt, defined as short-term and long-term debt less

cash and cash equivalents, to equity, defined as shareholders’ equity and minority interests, was

-71%, -61%, and -41% at December 31, 2003, 2002 and 2001, respectively. The change in 2003

resulted from both our continued good profitability and the improvements in our cash position.

The total dividends per share were EUR 0.30 for the year ended December 31, 2003, subject to

shareholders’ approval (EUR 0.28 and EUR 0.27 for the years ended December 31, 2002 and 2001,

respectively). See ‘‘Item 3.A Selected Financial Data—Distribution of Earnings.’’

Nokia has no potentially significant refinancing requirements in 2004. Nokia expects to incur

additional indebtedness from time to time as required to finance working capital needs. At

December 31, 2003, Nokia had a USD 500 million US Commercial Paper (USCP) program and a USD

500 million Euro Commercial Paper (ECP) program. In addition, at the same date, Nokia had a

Finnish local commercial paper program totaling EUR 750 million. At December 31, 2003, we also

had a committed credit facility of USD 2 000 million and a number of short-term uncommitted

facilities. For further information regarding our short-term borrowings, including the average

interest rate, see Note 25 to our consolidated financial statements included in Item 18 of this

Form 20-F.

Nokia has historically maintained a high level of liquid assets. Management estimates that the cash

and cash equivalents level of EUR 11 296 million at the end of 2003, together with Nokia’s

available credit facilities, cash flow from operations, funds available from long-term and

short-term debt financings, as well as the proceeds of future equity or convertible bond offerings,

will be sufficient to satisfy our future working capital needs, capital expenditure, research and

development and debt service requirements at least through 2004. The ratings of our short and

long-term debt from credit rating agencies have not changed during the year. The ratings at

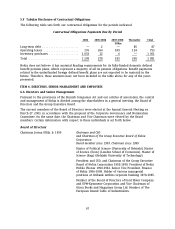

December 31, 2003, were:

Short-term Standard & Poor’s A-1

Moody’s P-1

Long-term Standard & Poor’s A

Moody’s A1

We believe that Nokia will continue to be able to access the capital markets on terms and in

amounts that will be satisfactory to us, and that we will be able to obtain bid and performance

bonds, to arrange or provide customer financing as necessary to support our business and to

engage in hedging transactions on commercially acceptable terms.

60