Nokia 2003 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2003 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Consolidated Financial Statements (Continued)

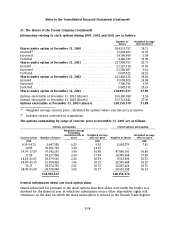

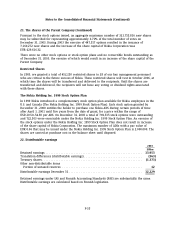

21. The shares of the Parent Company (Continued)

value of EUR 0.06 within one year as of the resolution of the Annual General Meeting. The share

capital may be increased in deviation from the shareholders’ pre-emptive rights for share

subscription provided that important financial grounds exist such as financing or carrying out of

an acquisition or another arrangement and granting incentives to key persons. In 2003, the Board

of Directors has increased the share capital on the basis of this authorization by an aggregate of

EUR 73,502.82 consisting of 1,225,047 new shares, as a result of which the unused authorization

amounted to EUR 56,926,497.18, corresponding to 948,774,953 shares on December 31, 2003. The

authorization is effective until March 27, 2004.

At the end of 2003, the Board of Directors had no other authorizations to issue shares, convertible

bonds, warrants or stock options.

Other authorizations

At the Annual General Meeting held on March 27, 2003 Nokia shareholders authorized the Board of

Directors to repurchase a maximum of 225 million Nokia shares, representing less than 5% of total

shares outstanding, and to resolve on the disposal of a maximum of 225 million Nokia shares. In

2003, a total of 94,478,500 shares were repurchased under the buy-back authorization, as a result

of which the unused authorization amounted to 130,521,500 shares on December 31, 2003. No

shares were disposed of in 2003 under the respective authorization. The authorization to dispose

of the shares may be carried out pursuant to terms determined by the Board provided that

important financial grounds exist such as financing or carrying out acquisitions or other

arrangements, as well as granting incentives to key persons. These authorizations are effective

until March 27, 2004.

F-32