Nokia 2003 Annual Report Download - page 65

Download and view the complete annual report

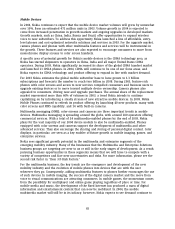

Please find page 65 of the 2003 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The upturn was largely due to high volumes in growth markets where mobile telephony became

more affordable. Also in 2003, feature-rich mobile devices continued to make significant inroads in

countries with higher cellular penetration, paving the way for the adoption of new technologies

and services. Even though the mobile network infrastructure market continued its decline in 2003,

encouraging signs in the fourth quarter indicated that the market was beginning to stabilize as

the financial position of operators improved, leading to an overall spending increase in the

market.

Technologies

In technology, two notable industry trends are emerging. First, the convergence of the mobile

communications, information technology and media industries into one mobility industry is

becoming apparent. This development opens the possibility for entirely new product and service

categories, such as mobile games, multimedia and enterprise solutions. Second, while participants

in the mobile communications industry once provided complete products and solutions, the

mobility industry will include increasing numbers of participants that provide specific hardware

and software layers for products and solutions. We expect that certain layers will have increasing

value from a business perspective, which may also result in shifts of value among different

industry participants. Although both of these trends present new challenges, as described above in

the first two risk factors in ‘‘Item 3.D Risk Factors,’’ we believe that these trends also expand the

potential for future growth in the mobile communications industry.

The significance of software in consumer and business-focused mobile devices is increasing.

Software enables valuable applications and intuitive user interfaces, which drive mobile device

use, boost the mobile services market and benefit many players in the mobility industry. Nokia

sees Java, the Symbian operating system (OS) and the Series 60 handset software platform as key

elements in this evolution. Java enables the creation and downloading of mobile device

applications that attract more consumers and business users. The installed base of advanced

mobile devices running the Symbian OS reached several million units in 2003. The Nokia-licensed

Series 60 platform incorporates open technologies, including MMS, Java and the Symbian OS, and is

expected to move beyond advanced phones to volume products in the coming years.

While 2002 featured initial rollouts of 3G mobile communications technologies, such as WCDMA

and EDGE, 2003 witnessed the commercial deployment of 3G with 12 commercial WCDMA

networks launched by operators and 11 EDGE networks. The transition from 2G to 3G is a process

that is expected to take several years, although we expect the full-scale commercialization of 3G

mobile devices and the launch of more than 50 WCDMA 3G networks to have taken place by the

end of 2004.

We believe that open standards continue to be an important building block for enabling the

interoperability needed to take advantage of networked services. SMS, MMS and other multimedia

services become more valuable to all the market participants as the number of users who can

access them increases. Open standards also ensure a sustainable, global mobile software and

services business. The evolution of applications and services in the mobile communications

industry has led to greater cooperation among industry players, facilitating faster adoption of

mobile services as well as market growth for the entire mobile communications industry. Nokia

continues to drive and implement open standards in cooperation with various industry

participants in order to promote a multi-vendor market with open competition and

interoperability worldwide. For more information, please see the first risk factor in ‘‘Item 3.D Risk

Factors.’’

64