Nokia 2003 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2003 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements (Continued)

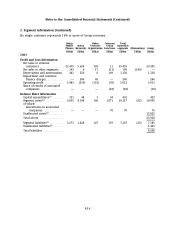

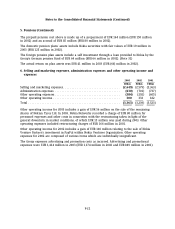

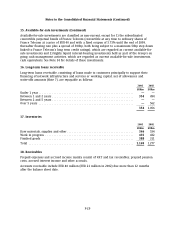

7. Impairment

Nokia Nokia Common

Mobile Nokia Ventures Group

2003 Phones Networks Organization Functions Group

EURm EURm EURm EURm EURm

Customer finance impairment charges, net of

reversals .............................. — (226) — — (226)

Impairment of goodwill .................... — 151 — — 151

Impairment of available-for-sale investments . . . — — 27 — 27

Impairment of capitalized development costs . . . — 275 — — 275

Total, net ............................... — 200 27 — 227

2002

EURm EURm EURm EURm EURm

Customer finance impairment charges, net ..... — 279 — — 279

Impairment of goodwill .................... — 121 61 — 182

Impairment of available-for-sale investments . . . — — 22 55 77

Total, net ............................... — 400 83 55 538

2001

EURm EURm EURm EURm EURm

Customer finance impairment charges ........ — 714 — — 714

Impairment of goodwill .................... — 211 307 — 518

Impairment of available-for-sale investments . . . — — 6 74 80

Total ................................... — 925 313 74 1,312

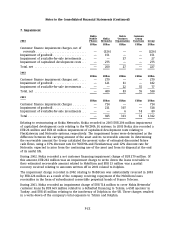

Relating to restructuring at Nokia Networks, Nokia recorded in 2003 EUR 206 million impairment

of capitalized development costs relating to the WCDMA 3G systems. In 2003 Nokia also recorded a

EUR 26 million and EUR 43 million impairment of capitalized development costs relating to

FlexiGateway and Metrosite systems, respectively. The impairment losses were determined as the

difference between the carrying amount of the asset and its recoverable amount. In determining

the recoverable amount the Group calculated the present value of estimated discounted future

cash flows, using a 15% discount rate for WCDMA and FlexiGateway and 12% discount rate for

Metrosite, expected to arise from the continuing use of the asset and from its disposal at the end

of its useful life.

During 2002, Nokia recorded a net customer financing impairment charge of EUR 279 million. Of

this amount, EUR 292 million was an impairment charge to write down the loans receivable to

their estimated recoverable amount related to MobilCom and EUR 13 million was a partial

recovery received relating to amounts written off in 2001 related to Dolphin.

The impairment charge recorded in 2002 relating to MobilCom was substantially reversed in 2003

by EUR 226 million as a result of the company receiving repayment of the MobilCom loans

receivables in the form of subordinated convertible perpetual bonds of France Telecom.

During 2001, Nokia recorded an impairment charge of EUR 714 million to cover Nokia Networks’

customer loans by EUR 669 million related to a defaulted financing to Telsim, a GSM operator in

Turkey, and EUR 45 million relating to the insolvency of Dolphin in the UK. These charges resulted

in a write-down of the company’s total exposure to Telsim and Dolphin.

F-22