Nokia 2003 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2003 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements (Continued)

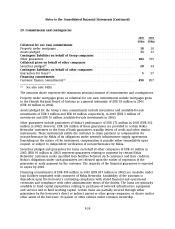

29. Commitments and contingencies (Continued)

The Group is party to routine litigation incidental to the normal conduct of business. In the

opinion of management the outcome of and liabilities in excess of what has been provided for

related to these proceedings, in the aggregate, are not likely to be material to the financial

condition or results of operations.

As of December 31, 2003, the Group had purchase commitments of EUR 1,051 million (EUR 949

million in 2002) relating to inventory purchase obligations, primarily for purchases in 2004.

30. Leasing contracts

The Group leases office, manufacturing and warehouse space under various non-cancellable

operating leases. Certain contracts contain renewal options for various periods of time.

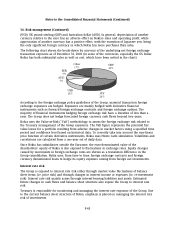

The future costs for non-cancellable leasing contracts are as follows:

Operating

leases

Leasing payments, EURm

2004 ................................................................ 176

2005 ................................................................ 147

2006 ................................................................ 117

2007 ................................................................ 102

2008 ................................................................ 87

Thereafter ............................................................ 124

Total ................................................................ 753

Rental expense amounted to EUR 285 million in 2003 (EUR 384 million in 2002 and EUR 393

million in 2001).

31. Related party transactions

Nokia Pension Foundation is a separate legal entity that manages and holds in trust the assets for

the Group’s Finnish employee benefit plans; these assets include 0.03% of Nokia’s shares. In 2002

Nokia Pension Foundation was the counterparty to equity swap agreements with the Group. The

equity swaps were entered into to hedge part of the company’s liability relating to future social

security cost on stock options. During 2003, all outstanding transactions were terminated and no

new ones were entered into. During 2002 new transactions were entered into and old ones

terminated based on the hedging need. The transactions and terminations were executed on

standard commercial terms and conditions. The notional amount of the equity swaps outstanding

at December 31, 2002 was EUR 12 million and the fair value EUR 0 million.

At December 31, 2003 the Group had no contribution payment liability to Nokia Pension

Foundation (EUR 14 million in 2002 included in accrued expenses).

At December 31, 2003 the Group had borrowings amounting to EUR 64 million (EUR 66 million in

2002) from Nokia Unterst ¨

utzungskasse GmbH, the Group’s German pension fund, which is a

separate legal entity.

F-40