Nokia 2003 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2003 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Consolidated Financial Statements (Continued)

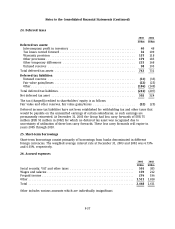

34. Risk management (Continued)

(3) Included within current Available-for-sale investments is EUR 31 million and EUR 44 million

of restricted cash at December 31, 2003 and 2002, respectively.

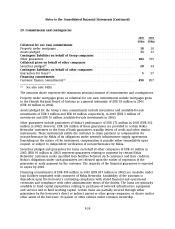

c) Liquidity risk

Nokia guarantees a sufficient liquidity at all times by efficient cash management and by investing

in liquid interest bearing securities. Due to the dynamic nature of the underlying business

Treasury also aims at maintaining flexibility in funding by keeping committed and uncommitted

credit lines available. During the year Nokia refinanced all its Revolving Credit Facilities. At the

end of December 31, 2003 the new committed facility totaled USD 2.0 billion. The committed credit

facility is intended to be used for U.S. and Euro Commercial Paper Programs back up purposes. The

commitment fee on the facility is 0.10% per annum.

The most significant existing funding programs include:

Revolving Credit Facility of USD 2,000 million, maturing in 2008

Local commercial paper program in Finland, totaling EUR 750 million

Euro Commercial Paper (ECP) program, totaling USD 500 million

US Commercial Paper (USCP) program, totaling USD 500 million

None of the above programs have been used to a significant degree in 2003.

Nokia’s international creditworthiness facilitates the efficient use of international capital and loan

markets. The ratings of Nokia from credit rating agencies have not changed during the year. The

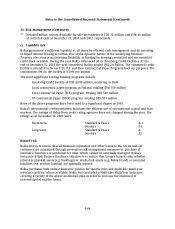

ratings as at December 31, 2003 were:

Short-term Standard & Poor’s A-1

Moody’s P-1

Long-term Standard & Poor’s A

Moody’s A1

Hazard risk

Nokia strives to ensure that all financial, reputation and other losses to the Group and our

customers are minimized through preventive risk management measures or purchase of

insurance. Insurance is purchased for risks, which cannot be internally managed. Nokia’s

Insurance & Risk Finance function’s objective is to ensure that Group’s hazard risks, whether

related to physical assets (e.g. buildings) or intellectual assets (e.g. Nokia brand) or potential

liabilities (e.g. product liability) are optimally insured.

Nokia purchases both annual insurance policies for specific risks and multi-line multi-year

insurance policies, where available. Nokia has concluded a Multi-Line Multi-Year Insurance

covering a variety of the above mentioned risks in order to decrease the likelihood of

non-anticipated sudden losses.

F-46