Nokia 2003 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2003 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31JAN200410095061

Notes to the Consolidated Financial Statements (Continued)

34. Risk management (Continued)

(USD), UK pound sterling (GBP) and Australian dollar (AUD). In general, depreciation of another

currency relative to the euro has an adverse effect on Nokia’s sales and operating profit, while

appreciation of another currency has a positive effect, with the exception of Japanese yen, being

the only significant foreign currency in which Nokia has more purchases than sales.

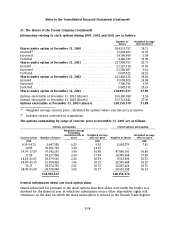

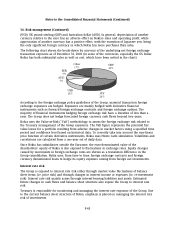

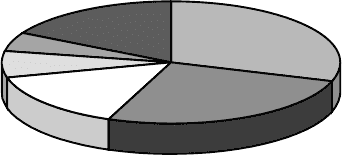

The following chart shows the break-down by currency of the underlying net foreign exchange

transaction exposure as of December 31, 2003 (in some of the currencies, especially the US dollar,

Nokia has both substantial sales as well as cost, which have been netted in the chart).

A

UD

7%

SEK

5%

Other

17%

USD

15% JPY

26%

GBP

30%

According to the foreign exchange policy guidelines of the Group, material transaction foreign

exchange exposures are hedged. Exposures are mainly hedged with derivative financial

instruments such as forward foreign exchange contracts and foreign exchange options. The

majority of financial instruments hedging foreign exchange risk have a duration of less than a

year. The Group does not hedge forecasted foreign currency cash flows beyond two years.

Nokia uses the Value-at-Risk (‘‘VaR’’) methodology to assess the foreign exchange risk related to

the Treasury management of the Group exposures. The VaR figure represents the potential fair

value losses for a portfolio resulting from adverse changes in market factors using a specified time

period and confidence level based on historical data. To correctly take into account the non-linear

price function of certain derivative instruments, Nokia uses Monte Carlo simulation. Volatilities and

correlations are calculated from a one-year set of daily data.

Since Nokia has subsidiaries outside the Eurozone, the euro-denominated value of the

shareholders’ equity of Nokia is also exposed to fluctuations in exchange rates. Equity changes

caused by movements in foreign exchange rates are shown as a translation difference in the

Group consolidation. Nokia uses, from time to time, foreign exchange contracts and foreign

currency denominated loans to hedge its equity exposure arising from foreign net investments.

Interest rate risk

The Group is exposed to interest rate risk either through market value fluctuations of balance

sheet items (i.e. price risk) and through changes in interest income or expenses (i.e. re-investment

risk). Interest rate risk mainly arises through interest-bearing liabilities and assets. Estimated

future changes in cash flows and balance sheet structure also expose the Group to interest rate

risk.

Treasury is responsible for monitoring and managing the interest rate exposure of the Group. Due

to the current balance sheet structure of Nokia, emphasis is placed on managing the interest rate

risk of investments.

F-43