Nokia 2003 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2003 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements (Continued)

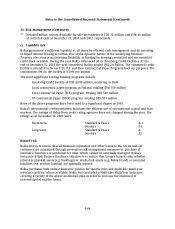

34. Risk management (Continued)

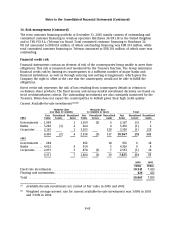

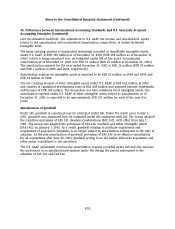

Notional amounts of derivative financial instruments(1)

2003 2002

EURm EURm

Foreign exchange forward contracts(2) ................................... 10,271 11,118

Currency options bought(2) ............................................ 2,924 1,408

Currency options sold(2) .............................................. 2,478 1,206

Interest rate swaps .................................................. 1,500 —

Cash settled equity options(3) .......................................... 228 209

Cash settled equity swaps(3) ........................................... —12

(1) Includes the gross amount of all notional values for contracts that have not yet been settled

or cancelled. The amount of notional value outstanding is not necessarily a measure or

indication of market risk, as the exposure of certain contracts may be offset by that of other

contracts.

(2) As at December 31, 2003 notional amounts include contracts amounting to EUR 3 billion used

to hedge the shareholders’ equity of foreign subsidiaries (December 31, 2002 EUR 2 billion).

(3) Cash settled equity swaps and options can be used to hedge risk relating to incentive

programs and investment activities.

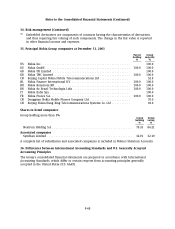

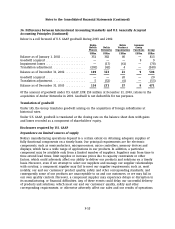

Fair values of derivatives

The net fair values of derivative financial instruments at the balance sheet date were:

2003 2002

EURm EURm

Derivatives with positive fair value(1):

Forward foreign exchange contracts(2) ................................. 358 235

Currency options bought ............................................ 59 21

Cash settled equity options .......................................... 13 28

Interest rate swaps ................................................ 1—

Embedded derivatives(3) ............................................ 25 14

Derivatives with negative fair value(1):

Forward foreign exchange contracts(2) ................................. (108) (98)

Currency options written ........................................... (35) (7)

Embedded derivatives(3) ............................................ (8) —

(1) Out of the forward foreign exchange contracts and currency options, fair value EUR 90 million

was designated for hedges of net investment in foreign subsidiaries as at December 31, 2003

(EUR 36 million at December 31, 2002) and reported in translation difference.

(2) Out of the foreign exchange forward contracts, fair value EUR 33 million was designated for

cash flow hedges as at December 31, 2003 (EUR 31 million at December 31, 2002) and

reported in fair value and other reserves.

F-47