Nokia 2003 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2003 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Consolidated Financial Statements (Continued)

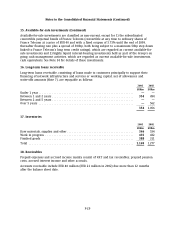

20. Fair value and other reserves (Continued)

In order to ensure that amounts deferred in the cash flow hedging reserve represent only the

effective portion of gains and losses on properly designated hedges of future transactions that

remain highly probable at the balance sheet date, Nokia has adopted a process under which all

derivative gains and losses are initially recognized in the profit and loss account. The appropriate

reserve balance is calculated at the end of each period and posted to equity.

Nokia continuously reviewed the underlying cash flows and the hedges allocated thereto, to

ensure that the amounts transferred to the Hedging Reserve during the year ended December 31,

2003 and 2002 did not include gains/losses on forward exchange contracts designated to hedge

forecasted sales or purchases that are no longer expected to occur. Because of the number of

transactions undertaken during each period and the process used to calculate the reserve balance,

separate disclosure of the transfers of gains and losses to and from the reserve would be

impractical.

All of the net fair value gains or losses recorded in the Fair value and other reserve at

December 31, 2003 on open forward foreign exchange contracts which hedge anticipated future

foreign currency sales or purchases are transferred from the Hedging Reserve to the profit and

loss account when the forecasted foreign currency cash flows occur, at various dates up to 1 year

from the balance sheet date.

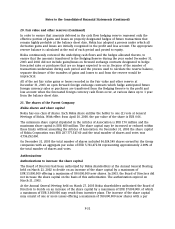

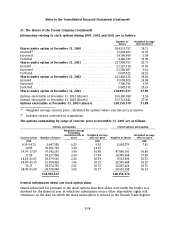

21. The shares of the Parent Company

Nokia shares and share capital

Nokia has one class of shares. Each Nokia share entitles the holder to one (1) vote at General

Meetings of Nokia. With effect from April 10, 2000, the par value of the share is EUR 0.06.

The minimum share capital stipulated in the Articles of Association is EUR 170 million and the

maximum share capital is EUR 680 million. The share capital may be increased or reduced within

these limits without amending the Articles of Association. On December 31, 2003 the share capital

of Nokia Corporation was EUR 287,777,547.60 and the total number of shares and votes was

4,796,292,460.

On December 31, 2003 the total number of shares included 96,024,549 shares owned by the Group

companies with an aggregate par value of EUR 5,761,472.94 representing approximately 2.00% of

the total number of shares and votes.

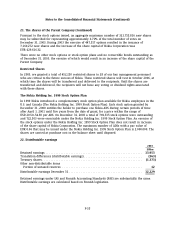

Authorizations

Authorizations to increase the share capital

The Board of Directors had been authorized by Nokia shareholders at the Annual General Meeting

held on March 21, 2002 to decide on an increase of the share capital by a maximum of

EUR 55,800,000 offering a maximum of 930,000,000 new shares. In 2003, the Board of Directors did

not increase the share capital on the basis of this authorization. The authorization expired on

March 21, 2003.

At the Annual General Meeting held on March 27, 2003 Nokia shareholders authorized the Board of

Directors to decide on an increase of the share capital by a maximum of EUR 57,000,000, of which

a maximum of EUR 3,000,000 may result from incentive plans. The increase of the share capital

may consist of one or more issues offering a maximum of 950,000,000 new shares with a par

F-31