Nokia 2003 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2003 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

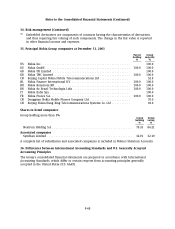

Notes to the Consolidated Financial Statements (Continued)

36. Differences between International Accounting Standards and U.S. Generally Accepted

Accounting Principles (Continued)

The principal differences between IAS and U.S. GAAP are presented below together with

explanations of certain adjustments that affect consolidated net income and total shareholders’

equity as of and for the years ended December 31:

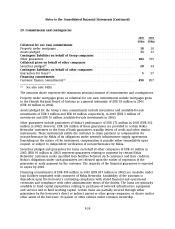

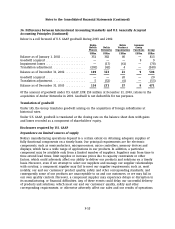

2003 2002 2001

EURm EURm EURm

Reconciliation of net income:

Net income reported under IAS ................................ 3,592 3,381 2,200

U.S. GAAP adjustments:

Pension expense .......................................... (12) (5) (22)

Development costs ........................................ 322 (66) (104)

Provision for social security cost on stock options ............... (21) (90) (132)

Stock compensation expense ................................ (9) (35) (85)

Cash flow hedges ......................................... 96 (22)

Net investment in foreign companies ......................... —48 —

Amortization of identifiable intangible assets acquired ........... (22) (22) (7)

Amortization of goodwill ................................... 162 206 28

Impairment of goodwill .................................... 151 104 —

Deferred tax effect of U.S. GAAP adjustments ................... (75) 76 47

Net income under U.S. GAAP .................................. 4,097 3,603 1,903

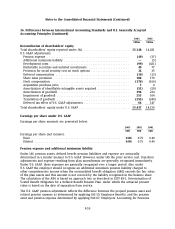

Presentation of comprehensive income under U.S. GAAP:

Other comprehensive income:

Foreign currency translation adjustment ...................... (273) (465) (21)

Additional minimum liability, net of tax ....................... 3(3) —

Net gains (losses) on cash flow hedges, net of tax ............... (4) 56 96

Net unrealized (losses) gains on securities, net of tax

Net unrealized holding (losses) gains during the year, net of tax . . 71 (78) (67)

Transfer to profit and loss account on impairment, net of tax .... 27 67 74

Less: Reclassification adjustment on disposal, net of tax ........ (27) 1 (7)

Other comprehensive income ................................. (203) (422) 75

Comprehensive income ...................................... 3,894 3,181 1,978

F-49