Nokia 2003 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2003 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The global networks business relies on a limited number of customers and large multi-year

contracts. Unfavorable developments under a major contract or in relation to a major

customer may affect our sales, our results of operations and cash flow adversely.

Large multi-year contracts, which are typical in the networks industry, include a risk that the

timing of sales and results of operations associated with these contracts will be different than

expected. Moreover, they usually require the dedication of substantial amounts of working capital

and other resources, which impacts our cash flow negatively. Any non-performance by us under

these contracts may have significant adverse consequences for us because network operators have

demanded and may continue to demand stringent contract undertakings such as penalties for

contract violations.

Customer financing to network operators can be a competitive requirement and could affect

our sales, results of operations, balance sheet and cash flow adversely.

Network operators in some markets sometimes require their suppliers, including us, to arrange or

provide long-term financing as a condition to obtaining or bidding on infrastructure projects.

Moreover, they may require extended payment terms which mean that we must extend

short-term trade credits to them. In some cases, the amounts and duration of these financings and

trade credits, and the associated impact on our working capital, may be significant.

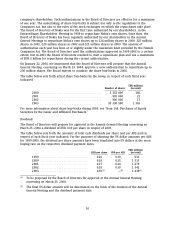

At December 31, 2003 our outstanding long-term loans to customers totaled EUR 354 million, while

financial guarantees given on behalf of third parties totaled EUR 33 million. In addition, we had

financing commitments totaling EUR 490 million. Total customer financing (outstanding and

committed) was EUR 877 million. In 2003, we reduced our total customer financing (outstanding

and committed) by EUR 1 127 million (or 56%) compared to 2002. Our continued intent is to

further mitigate our total customer financing exposure, market conditions permitting. We continue

to make arrangements with financial institutions and investors to sell credit risk we have

incurred from the commitments and outstanding loans we have made as well as from the

financial guarantees we have given.

The financial requirements for building our telecommunication networks are substantial. Some

operators do not have an established customer base or revenue streams. Defaults by some of these

operators have occurred in the past, and could occur again in the future for reasons beyond our

control. This could result in the restructuring of customer financing arrangements and/or require

us to re-assess the ultimate collectibility of such financings or trade credits. As a result, write-offs

of all or a portion of the outstanding loan balances could occur and this may negatively impact

our results of operations. In 2001, we recorded an impairment charge of EUR 714 million in our

networks business’s customer loans related to a defaulted financing to Telsim (EUR 669 million), a

GSM operator in Turkey, and to the insolvency of Dolphin in the United Kingdom (EUR 45 million).

In 2002, we recorded a net customer financing impairment charge of EUR 279 million. Of this

amount, EUR 292 million was an impairment charge to write down the loans receivable to their

estimated recoverable amount related to MobilCom, a German operator, and EUR 13 million was a

partial recovery received relating to amounts written off in 2001 related to Dolphin. However, the

charge relating to MobilCom was substantially reversed in 2003 by EUR 226 million as a result of

our receiving repayment of the MobilCom loans receivables in the form of subordinated

convertible perpetual bonds of France Telecom.

We see the current industry environment as requiring only non-material increases, if any, in

customer financing. Customer financing continues to be requested by some operators in some

markets, but to a considerably lesser extent and with considerably lower importance than during

the past years. As a strategic market requirement, we plan to continue to extend customer

financing and provide extended payment terms to a small number of selected customers. Extended

payment terms may continue to result in a material aggregate amount of trade credits, but the

18