Nokia 2003 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2003 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements (Continued)

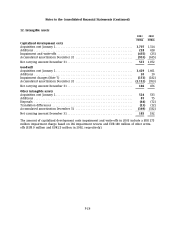

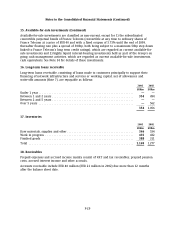

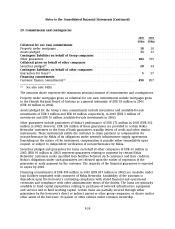

15. Available-for-sale investments (Continued)

Available-for-sale investments are classified as non-current, except for 1) the subordinated

convertible perpetual bonds of France Telecom (convertible at any time to ordinary shares of

France Telecom at a price of EUR 40 and with a fixed coupon of 5.75% until the end of 2009,

thereafter floating rate plus a spread of 300bp, both being subject to a maximum 50bp step down

linked to France Telecom’s long term credit ratings), which are regarded as current available-for-

sale investments and 2) highly liquid, interest-bearing investments held as part of the Group’s on

going cash management activities, which are regarded as current available-for-sale investments,

cash equivalents. See Note 34 for details of these investments.

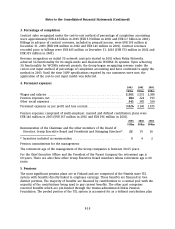

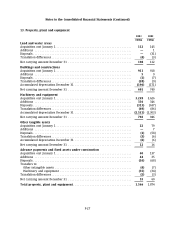

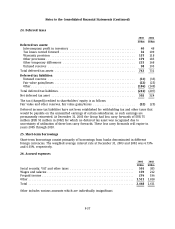

16. Long-term loans receivable

Long-term loans receivable, consisting of loans made to customers principally to support their

financing of network infrastructure and services or working capital, net of allowances and

write-offs amounts (Note 7), are repayable as follows:

2003 2002

EURm EURm

Under 1 year ......................................................... ——

Between 1 and 2 years ................................................. 354 494

Between 2 and 5 years ................................................. ——

Over 5 years ......................................................... —562

354 1,056

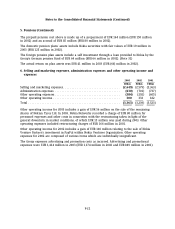

17. Inventories

2003 2002

EURm EURm

Raw materials, supplies and other ........................................ 346 534

Work in progress ..................................................... 435 432

Finished goods ....................................................... 388 311

Total ............................................................... 1,169 1,277

18. Receivables

Prepaid expenses and accrued income mainly consist of VAT and tax receivables, prepaid pension

costs, accrued interest income and other accruals.

Accounts receivable include EUR 40 million (EUR 21 million in 2002) due more than 12 months

after the balance sheet date.

F-29