Nokia 2003 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2003 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements (Continued)

36. Differences between International Accounting Standards and U.S. Generally Accepted

Accounting Principles (Continued)

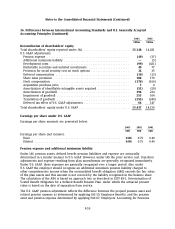

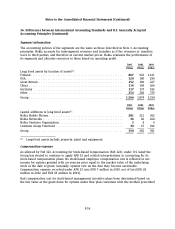

2003 2002

Domestic Foreign Domestic Foreign

plans plans plans plans

EURm EURm

Plan assets at fair value at beginning of year ............. 636 126 664 123

Remeasurement .................................... —52 ——

Foreign exchange ................................... —(3)— (2)

Actual return on plan assets ........................... 27 13 (53) (12)

Employer contribution ............................... 27 20 32 22

Plan participants’ contributions ........................ —3—3

Benefits paid ....................................... (7) (7) (7) (8)

Plan assets at fair value at end of year .................. 683 204 636 126

Excess (deficit) of plan assets over

projected benefit obligation ........................... 17 (139) 97 (135)

Unrecognized transition obligation ...................... 2223

Unrecognized net (gain)/loss from experience differences .... 95 21 11 21

Unamortized prior service cost ......................... 32 — 34 —

Net amount recognized ............................... 146 (116) 144 (111)

Amounts recognized in the statement of financial positions

consist of:

Prepaid benefit cost ................................. 146 1 144 —

Accrued benefit liability .............................. — (117) — (116)

Intangible asset ..................................... ————

Accumulated other comprehensive income ............... ———5

Net amount recognized ............................... 146 (116) 144 (111)

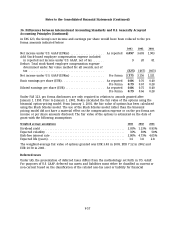

In both 2003 and 2002 the foreign plans had projected benefit obligations higher than assets. The

total Accumulated Benefit Obligation and Fair value of plan assets in respect of these plans were

EUR 281 million (EUR 229 million in 2002) and EUR 204 million (EUR 126 million in 2002)

respectively.

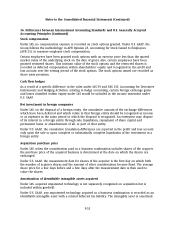

Weighted average assumptions used in calculation of pension obligations are as follows:

2003 2002

Domestic Foreign Domestic Foreign

%%%%

Discount rate for determining present values ............. 5.25 5.30 5.50 5.58

Expected long term rate of return on plan assets .......... 6.00 6.87 7.25 6.56

Annual rate of increase in future compensation levels ...... 3.50 3.49 3.50 3.09

Pension increases ................................... 2.30 2.27 2.30 2.29

The Group also contributes to multiemployer plans, insured plans and defined contribution plans.

Such contributions were approximately EUR 146 million, EUR 167 million and EUR 195 million in

2003, 2002 and 2001, respectively, including premiums associated with pooled benefits.

F-60