Nokia 2003 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2003 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

our pension plan assets. This volatility may make it difficult to estimate the long-term rate of

return on plan assets. Actual results that differ from our assumptions are accumulated and

amortized over future periods and therefore generally affect our recognized expense and recorded

obligation in such future periods. Our assumptions are based on actual historical experience and

external data regarding compensation and discount rate trends. While we believe that our

assumptions are appropriate, significant differences in our actual experience or significant changes

in our assumptions may materially affect our pension obligation and our future expense.

Results of Operations

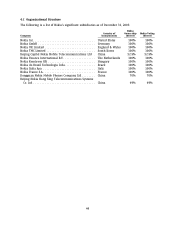

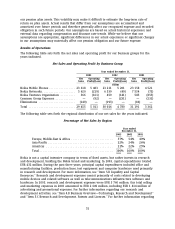

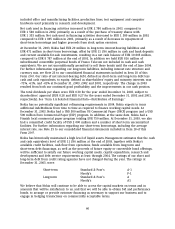

The following table sets forth the net sales and operating profit for our business groups for the

years indicated.

Net Sales and Operating Profit by Business Group

Year ended December 31,

2003 2002 2001

Net Operating Net Operating Net Operating

Sales Profit/(Loss) Sales Profit/(Loss) Sales Profit/(Loss)

EURm

Nokia Mobile Phones ................ 23 618 5 483 23 211 5 201 23 158 4 521

Nokia Networks .................... 5 620 (219) 6 539 (49) 7 534 (73)

Nokia Ventures Organization ......... 366 (161) 459 (141) 585 (855)

Common Group Expenses ............ — (92) — (231) — (231)

Eliminations ...................... (149) — (193) — (86) —

Total ............................ 29 455 5 011 30 016 4 780 31 191 3 362

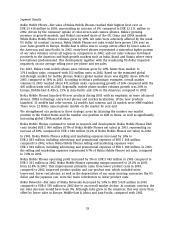

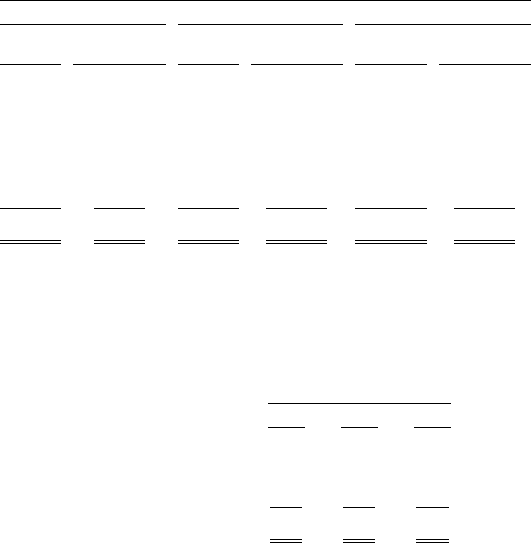

The following table sets forth the regional distribution of our net sales for the years indicated.

Percentage of Net Sales by Region

Year ended

December 31,

2003 2002 2001

Europe, Middle-East & Africa ......................... 57% 54% 49%

Asia-Pacific ....................................... 22% 24% 26%

Americas ........................................ 21% 22% 25%

Total ............................................ 100% 100% 100%

Nokia is not a capital intensive company in terms of fixed assets, but rather invests in research

and development, building the Nokia brand and marketing. In 2003, capital expenditures totaled

EUR 432 million. During the past three years, principal capital expenditures included office and

manufacturing facilities, production lines, test equipment and computer hardware used primarily

in research and development. For more information, see ‘‘Item 5.B Liquidity and Capital

Resources.’’ Research and development expenses consist primarily of costs related to developing

mobile devices and related software as well as telecommunications infrastructure software and

hardware. In 2003, research and development expenses were EUR 3 760 million. Our total selling

and marketing expenses in 2003 amounted to EUR 2 649 million, including EUR 1 414 million of

advertising and promotional expenses. For further information regarding our research and

development activities, see ‘‘Item 4.B Business Overview—Technology, Research and Development’’

and ‘‘Item 5.C Research and Development, Patents and Licenses.’’ For further information regarding

51