Nokia 2003 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2003 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Research and Development in Nokia’s Business Groups

Business group research and development is directed towards the commercialization of technology

and its integration into products and solutions. Although the business groups utilize technology

platforms where appropriate in an effort to achieve consistent high quality and economies of

scale, the research activities within the business groups also extend to business-specific

technologies, such as product mechanics and product-specific applications.

Competition

Mobile Phones and Devices

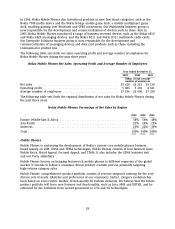

For 2003, the total mobile phone sales volumes achieved by the former Nokia Mobile Phones

reached a record level of 179.3 million units, representing growth of 18% compared with 2002.

Based on the estimated global sell-through market for mobile phones, Nokia’s global market share

was slightly above 38% for 2003, compared with 38% for 2002. This establishes Nokia as the

market leader, with a market share approximately equal to the combined share of our three

nearest competitors. According to Nokia’s preliminary estimates, overall market volumes in 2003

reached about 471 million units.

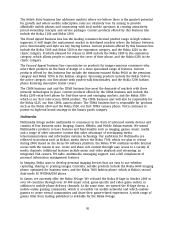

Mobile phone market participants compete mainly on the basis of the breadth and depth of their

product portfolios, price, operational and manufacturing efficiency, technical performance, product

features, quality, customer support, and brand recognition. Mobile network operators are

increasingly offering mobile phones under their own brand, which may result in increasing

competition from non-branded mobile device manufacturers.

Historically, our principal competitors have been other mobile communications companies such as

Ericsson, Motorola, Nortel, Samsung and Siemens. However, in future we will face new

competition, particularly in Multimedia and Enterprise Solutions where we will compete with

consumer electronics manufacturers and business device and solution providers, respectively.

Further, as the industry now includes increasing numbers of participants who provide specific

hardware and software layers within products and solutions, we will compete at the level of

these layers rather than solely at the level of products and solutions. As a result of these

developments, we face new competitors such as, but not limited to, Cisco, Dell, HP, Microsoft,

Nintendo and Sony, and we will also compete with a great number of smaller competitors and

with some of our traditional competitors in new areas.

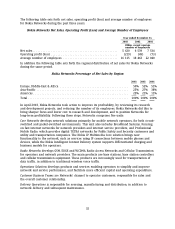

It is difficult to predict how the competitive landscape of the mobility industry will develop in the

future. In the mobility industry, the parameters of competition are less firmly established than in

mature, low-growth industries, where the competitive landscape does not change greatly from

year to year. See ‘‘Item 3.D Risk Factors—The development of the mobility industry is significantly

altering the competitive landscape and increasing competition. We are entering businesses where

the competitive landscape is new to us or still in the early stages of development. Our failure to

respond successfully to this development may have a material adverse impact on our business,

our ability to meet our targets, and our results of operations.’’

Networks

In the networks business, our principal competitors include Alcatel, Ericsson, Motorola, Nortel and

Siemens. Competition among vendors remains intense as the market contracts and operators

prioritize cash flow and rapid return on investment.

We are aiming to increase our market share in growth markets, by supporting operators to

achieve the lowest total cost of ownership for their networks. We do this by providing solutions

39