Nokia 2003 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2003 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

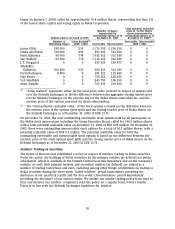

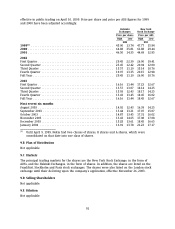

began on January 1, 2004) called for approximately 10.4 million shares, representing less than 1%

of the issued share capital and voting rights in Nokia Corporation.

Total potential realizable

Number of shares value of ‘‘In the Money’’

represented by shares represented by

outstanding options as of outstanding options as of

Options sold or exercised in 2003 December 31, 2003 December 31, 2003(2)

Number of Value Realized(1) Exercisable Unexercisable

Underlying Shares (EUR 1 000) Exercisable Unexercisable (EUR 1 000)

Jorma Ollila ...... 180 000 530 3 713 750 2 206 250 0 0

Pekka Ala-Pietil¨

a . . 720 000 891 993 436 521 564 0 0

Matti Alahuhta .... 80 000 774 1 032 812 312 188 0 0

Sari Baldauf ...... 80 000 774 1 112 812 312 188 0 0

J. T. Bergqvist ..... 0 0 293 125 126 875 0 0

Olli-Pekka

Kallasvuo ...... 300 000 631 692 812 312 188 0 0

Pertti Korhonen . . . 8 000 8 201 311 119 689 0 0

Yrj¨

o Neuvo ....... 0 0 756 561 138 439 0 0

Veli Sundb¨

ack..... 0 0 843 750 106 250 0 0

Anssi Vanjoki ..... 0 0 765 936 219 064 0 0

(1) ‘‘Value realized’’ represents either (a) the total gross value received in respect of options sold

over the Helsinki Exchanges or (b) the difference between the aggregate closing market price

(on the Helsinki Exchanges on the exercise day) of the Nokia shares subscribed for, and the

exercise price of the options exercised for share subscriptions.

(2) The ‘‘total potential realizable value’’ of the stock options is based on the difference between

the exercise price of the options (post split) and the closing market price of Nokia shares on

the Helsinki Exchanges as of December 31, 2003 of EUR 13.71.

On December 31, 2003, the total outstanding exercisable stock options held by all participants in

the Nokia stock option plans, including the Group Executive Board, called for 144.3 million shares,

with a total potential realizable value on December 31, 2003 of EUR 0.05 million. On December 31,

2003, there were outstanding unexercisable stock options for a total of 90.5 million shares, with a

potential realizable value of EUR 0.3 million. The potential realizable value for both the

outstanding exercisable and unexercisable stock options is based on the difference between the

exercise price of the stock options (post split) and the closing market price of Nokia shares on the

Helsinki Exchanges as of December 31, 2003 of EUR 13.71.

Insiders’ Trading in Securities

The Board of Directors has established a policy in respect of insiders’ trading in Nokia securities.

Under the policy, the holdings of Nokia securities by the primary insiders (as defined) are public

information, which is available in the Finnish Central Securities Depositary and on the company’s

website. As well, both primary insiders and secondary insiders (as defined) are subject to a

number of trading restrictions and rules, including among other things, prohibitions on trading in

Nokia securities during the three-week ‘‘closed-window’’ period immediately preceding the

disclosure of our quarterly results and the four-week ‘‘closed-window’’ period immediately

preceding the disclosure of our annual results. We update our insider trading policy from time to

time and monitor our insiders’ compliance with the policy on a regular basis. Nokia’s Insider

Policy is in line with the Helsinki Exchanges Guidelines for Insiders.

85