Nokia 2003 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2003 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements (Continued)

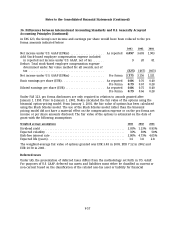

36. Differences between International Accounting Standards and U.S. Generally Accepted

Accounting Principles (Continued)

At December 31, approximately 3% (20% in 2002) or EUR 19 million (EUR 125 million in 2002) of

domestic plan assets consist of Nokia equity securities. The foreign pension plan assets include a

self investment through a loan provided to Nokia by the plan of EUR 64 million (EUR 66 million in

2002).

The following additional information as required in accordance with SFAS 132R, Employers

Disclosure about Pensions and Other Postretirement Benefits Revised, which was issued in

December 2003, relates to domestic plans only. The additional information disclosed regarding the

assets, obligations, cash flows and net periodic benefit costs of the Group’s domestic pension plans

will be disclosed for the Group’s foreign plans in 2004 in accordance with the provisions of

SFAS 132R.

The accumulated benefit obligation for the domestic plans at December 31, 2003 was

EUR 554 million (2002 EUR 479 million).

The Group expects to make contributions of EUR 27 million to its domestic pension plans in 2004.

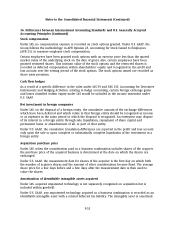

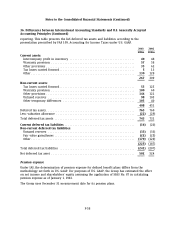

Domestic Plan Assets

The Groups’s pension plan weighted average asset allocation at December 31, 2002, and 2003, by

asset category are as follows:

Percentage of

Plan Assets

at December 31,

2003 2002

Asset Category:

Equity securities ................................................... 39% 53%

Debt securities .................................................... 33% 38%

Real estate ....................................................... 2% 4%

Short-term investments ............................................. 26% 5%

Total ............................................................ 100% 100%

The objective of the investment activities is to maximize investment return within an accepted

risk level. The relatively high average benefit liability duration is taken into consideration when

assessing investment strategies. As of December 31, 2003 the target asset allocation was: 40%

equity securities, 55% debt securities and 5% real estate. The Pension Foundation board of trustees

approves the target asset allocation as well as deviation limits. Derivative instruments can be used

to change the portfolio asset allocation and risk characteristics.

F-61