Nokia 2003 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2003 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Critical accounting policies

Our accounting policies affecting our financial condition and results of operations are more fully

described in Note 1 to our consolidated financial statements included in Item 18 of this Form 20-F.

Certain of Nokia’s accounting policies require the application of judgment by management in

selecting appropriate assumptions for calculating financial estimates, which inherently contain

some degree of uncertainty. Management bases its estimates on historical experience and various

other assumptions that are believed to be reasonable under the circumstances, the results of

which form the basis for making judgments about the reported carrying values of assets and

liabilities and the reported amounts of revenues and expenses that may not be readily apparent

from other sources. Actual results may differ from these estimates under different assumptions or

conditions.

Nokia believes the following are the critical accounting policies and related judgments and

estimates used in the preparation of its consolidated financial statements.

Revenue recognition

Revenue from the majority of the Group is recognized when persuasive evidence of an

arrangement exists, delivery has occurred, the fee is fixed and determinable and collectibility is

probable. The remainder of revenue is recorded under the percentage of completion method.

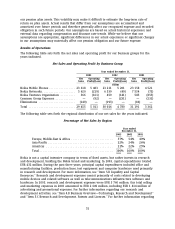

Nokia Mobile Phones’ and Nokia Ventures Organization’s, as well as certain of Nokia Networks’,

revenue is recognized when persuasive evidence of an arrangement exists, delivery has occurred,

the fee is fixed and determinable and collectibility is probable. This requires us to assess at the

point of delivery whether these criteria have been met. Upon making such assessment, revenue is

recognized. In particular, Nokia records estimated reductions to revenue for customer programs

and incentive offerings, including special pricing agreements, price protection and other volume

based discounts, mainly in the mobile phone business. Sales adjustments for volume based

discount programs are estimated based largely on historical activity under similar programs. Price

protection adjustments are based on estimates of future price reductions and certain agreed

customer inventories at the date of the price adjustment.

Nokia Networks’ revenue from contracts involving solutions achieved through modification of

telecommunications equipment is recognized on the percentage of completion basis when the

outcome of the contract can be estimated reliably. A contract’s outcome can be estimated reliably

when total contract revenue can be estimated reliably, it is probable that economic benefits

associated with the contract will flow to the company, and the stage of contract completion can be

measured reliably. When we are not able to meet those conditions, the policy is to recognize

revenues only equal to costs incurred to date, to the extent that such costs are expected to be

recovered. Completion is measured by reference to costs incurred to date as a percentage of

estimated total project costs.

The percentage of completion method relies on estimates of total expected contract revenue and

costs, as well as the dependable measurement of the progress made towards completing the

particular project. Recognized revenues and profit are subject to revisions during the project in the

event that the assumptions regarding the overall project outcome are revised. The cumulative

impact of a revision in estimates is recorded in the period such revisions become known and

estimable. Losses on projects in progress are recognized immediately when known and estimable.

Revenue recognition on initial 3G network contracts started in 2002 when Nokia Networks

achieved 3G functionality for its single-mode and dual-mode WCDMA 3G systems. Upon achieving

3G functionality for WCDMA network projects, we began recognizing revenue under the

cost-to-cost input method of percentage of completion accounting and have consistently applied

47