IBM 2003 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2003 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

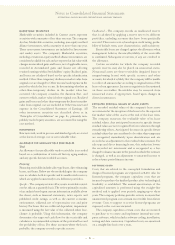

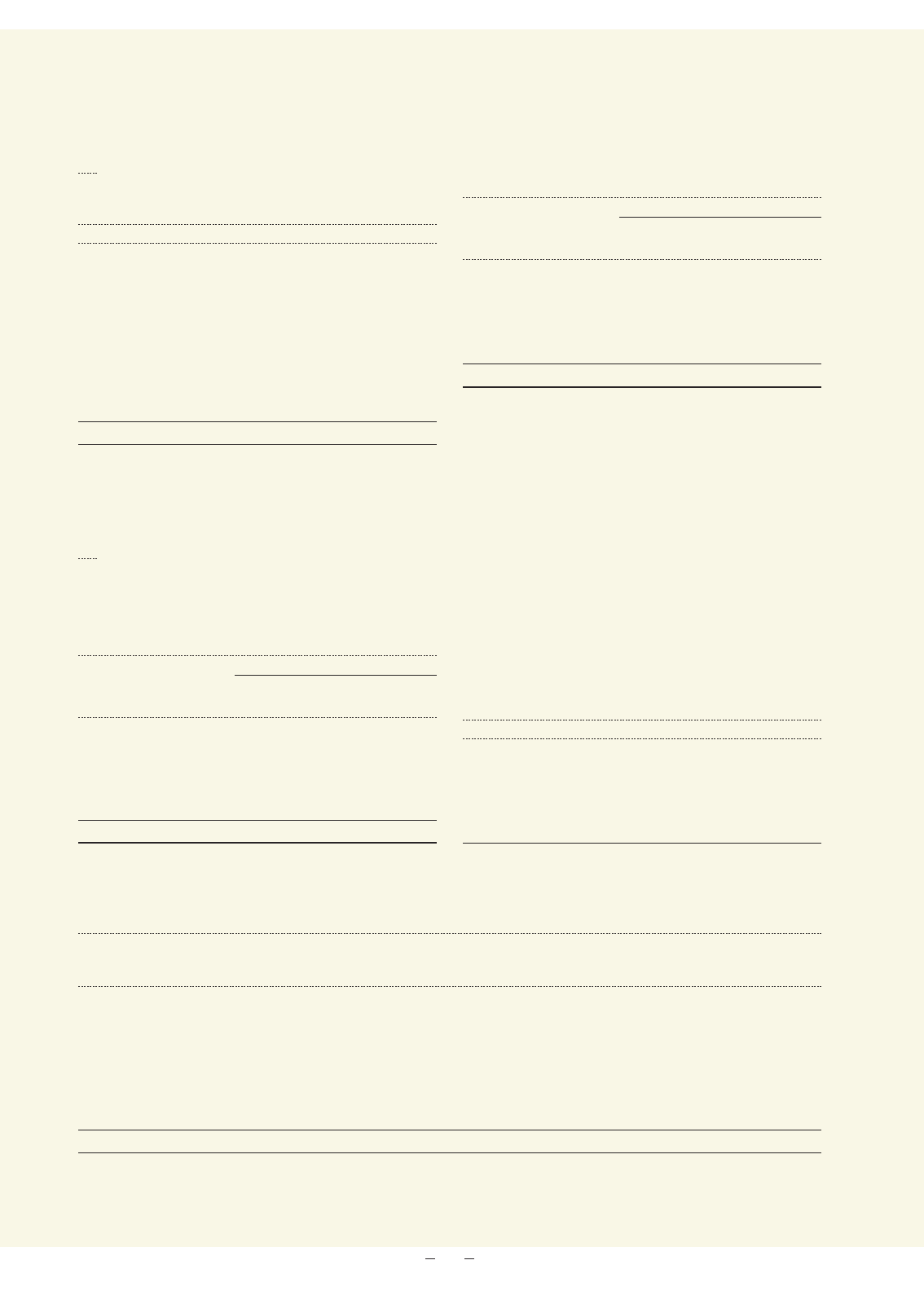

GOODWILL

The changes in the carrying amount of goodwill, by reporting segment, for the year ended December 31, 2003, are as follows:

(dollars in millions)

FOREIGN

BALANCE PURCHASE CURRENCY BALANCE

JAN. 1, GOODWILL PRICE TRANSLATION DEC. 31,

SEGMENT 2003 ADDITIONS ADJUSTMENTS DIVESTITURES ADJUSTMENTS 2003

Global Services $«2,926 $««««203*$«694 $«(6) $«367 $«4,184

Systems Group 137 ————137

Personal Systems Group 13 58 — — — 71

Technology Group 24 ————24

Software 1,015 1,439 40 — 11 2,505

Global Financing ——————

Enterprise Investments ——————

Total $«4,115 $«1,700 $«734 $«(6) $«378 $«6,921

*Relates to the purchase of the minority interest in a consolidated subsidiary.

There were no goodwill impairment losses recorded during the period.

94

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

H

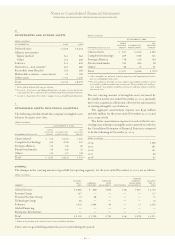

investments and sundry assets

(dollars in millions)

AT D ECEMBER 31: 2003 2002*

Deferred taxes $«4,288 $«4,314

Alliance investments:

Equity method 560 562

Other 234 249

Software 814 834

Derivatives—non-current** 695 689

Receivable from Hitachi+358 356

Marketable securities—non-current 59 192

Other assets 1,100 1,076

Total $«8,108 $«8,272

*Reclassified to conform with 2003 presentation.

** See note L, “Derivatives and Hedging Transactions,” on pages 96 to 99 for the fair

value of all derivatives reported in the Consolidated Statement of Financial Position.

+See note C, “Acquisitions/Divestitures,” on pages 89 to 92 for additional information.

I

intangible assets including goodwill

The following schedule details the company’s intangible asset

balances by major asset class.

(dollars in millions)

AT DECEMBER 31, 2002

GROSS NET

CARRYING ACCUMULATED CARRYING

INTANGIBLE ASSET CLASS AMOUNT AMORTIZATION AMOUNT

Client-related $««««517 $«(124) $«393

Completed technology 229 (108) 121

Strategic alliances 118 (15) 103

Patents/trademarks 109 (80) 29

Other*98 (7) 91

Total $«1,071 $«(334) $«737**

*Other intangibles are primarily acquired proprietary and nonproprietary business

processes, methodologies and systems.

** The $910 million at December 31, 2003, comprises $336 million recorded as current

assets and $574 million recorded as non-current assets. The $737 million at December 31,

2002, comprises $245 million recorded as current assets and $492 million recorded as

non-current assets.

(dollars in millions)

AT DECEMBER 31, 2003

GROSS NET

CARRYING ACCUMULATED CARRYING

INTANGIBLE ASSET CLASS AMOUNT AMORTIZATION AMOUNT

Client-related $««««704 $«(254) $«450

Completed technology 448 (228) 220

Strategic alliances 118 (38) 80

Patents/trademarks 98 (66) 32

Other*165 (37) 128

Total $«1,533 $«(623) $«910**

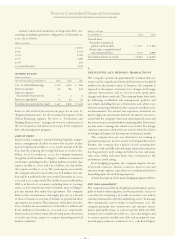

The net carrying amount of intangible assets increased by

$173 million for the year ended December 31, 2003, primarily

due to the acquisition of Rational, offset by the amortization

of existing intangible asset balances.

The aggregate amortization expense was $349 million

and $181 million for the years ended December 31, 2003 and

2002, respectively.

The future amortization expense for each of the five suc-

ceeding years relating to intangible assets currently recorded in

the Consolidated Statement of Financial Position is estimated

to be the following at December 31, 2003:

(dollars in millions)

2004 $«336

2005 261

2006 141

2007 84

2008 51