IBM 2003 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2003 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

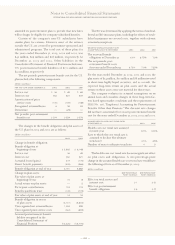

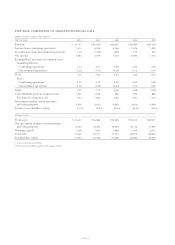

segment; and an Enterprise Investments segment. The seg-

ments are determined based on several factors, including

client base, homogeneity of products, technology and

delivery channels.

Information about each segment’s business and the prod-

ucts and services that generate each segment’s revenue is

located in the “Description of Business” section of the

Management Discussion on page 48 and pages 55 to 57.

In 2003, the company renamed all of its hardware segments

without changing the organization of these segments. The

Enterprise Systems segment was renamed the Systems

Group segment, the Personal and Printing Systems segment

was renamed the Personal Systems Group segment and the

Te chnology segment was renamed the Technology Group

segment.

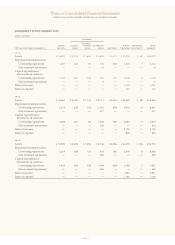

Due to the 2002 sale of the HDD business as described in

note C, “Acquisitions/Divestitures,” on page 92 and consistent

with the “Basis of Presentation” discussed in note A,

“Significant Accounting Policies,” on page 80, the income

statement and cash flow statement information for the

Technology Group segment has been reclassified to exclude

or to separate the results of the discontinued HDD business.

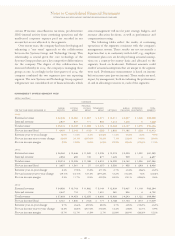

Segment revenue and pre-tax income include transac-

tions between the segments that are intended to reflect an

arm’s-length transfer price. Specifically, semiconductors are

sourced internally from the Technology Group segment for

use in the manufacture of the Systems Group segment and

Personal Systems Group segment products. In addition,

hardware and software that are used by the Global Services

segment in outsourcing engagements are mostly sourced

internally from the Systems Group, Personal Systems Group

and Software segments. For the internal use of IT services,

the Global Services segment recovers cost, as well as a reason-

able fee, reflecting the arm’s-length value of providing the

services. The Global Services segment enters into arm’s-length

leases at prices equivalent to market rates with the Global

Financing segment to facilitate the acquisition of equipment

used in services engagements. Generally, all internal transac-

tion prices are reviewed and reset annually, if appropriate.

The company uses shared-resources concepts to realize

economies of scale and efficient use of resources. Thus, a con-

siderable amount of expense is shared by all of the company’s

segments. This expense represents sales coverage, marketing

and support functions such as Accounting, Treasury,

Procurement, Legal, Human Resources, and Billing and

Collections. Where practical, shared expenses are allocated

based on measurable drivers of expense, e.g., headcount.

When a clear and measurable driver cannot be identified,

shared expenses are allocated on a financial basis that is con-

sistent with the company’s management system; e.g., image

advertising is allocated based on the gross profit of the

segments. The unallocated corporate amounts arising

from certain acquisitions, indirect infrastructure reductions,

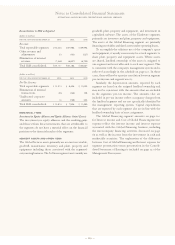

PLAN ASSETS

The company’s nonpension postretirement benefit plan

assets at December 31, 2003 and 2002 are comprised of

short-term fixed-income investments.

This plan is not funded. The company makes payments

from company funds as they become due and also maintains

a nominal, highly liquid fund balance to ensure payments are

made timely.

RECENTLY ENACTED LEGISLATION

The Medicare Prescription Drug Improvement and

Modernization Act of 2003 (the Act) was signed into law on

December 8, 2003. The Act introduces a prescription drug

benefit under Medicare (Medicare Part D) as well as a federal

subsidy to sponsors of retiree health care benefit plans that

provide a prescription drug benefit that is at least actuarially

equivalent to Medicare Part D.

SFAS No. 106, requires presently enacted changes in

relevant laws to be considered in current period measure-

ments of postretirement benefit costs and the BO. See page

116 for the BO and cost of the company’s U. S. nonpension

postretirement benefit plan.

In accordance with FSP FAS 106-1, “Accounting and

Disclosure Requirements Related to the Medicare Prescrip-

tion Drug, Improvement and Modernization Act of 2003,”

any measures of the BO or net periodic postretirement

benefit cost in the Consolidated Financial Statements or

accompanying notes do not reflect the effects of the Act on

the company’s postretirement health care plan.

The method of determining whether a sponsor’s plan will

qualify for actuarial equivalency is pending until the U.S.

Department of Health and Human Services (HHS) completes

its interpretative work on the Act. Once the interpretative

guidance is released by HHS and the FASB releases its

authoritative guidance on the appropriate method of

accounting for the subsidy, if eligible, the company could be

required to account for the subsidy (or a portion thereof) in

previously released financial statements. The FASB has not

finalized the accounting for the subsidy nor has it determined

its transition provisions.

X

segment information

IBM uses business insight and its portfolio of IT capabilities

to create client solutions. The company operates primarily in

a single industry using several segments that create value by

offering solutions that include, either singularly or in some

combination, services, software, hardware and financing.

Organizationally, the company’s major operations com-

prise a Global Services segment; a Software segment; three

hardware product segments—Systems Group, Personal

Systems Group and Technology Group; a Global Financing

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

117