IBM 2003 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2003 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

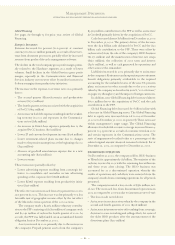

On January 1, 2003, the company reduced its expected

long-term return assumption on the U. S. IBM Personal

Pension Plan’s (PPP) assets from 9.5 percent to 8 percent. On

December 31, 2002, the company lowered its discount rate

assumption from 7 percent to 6.75 percent, and lowered its

rate of compensation increase from 6 percent to 4 percent.

Reductions in these rates also occurred in certain non-U. S.

countries. The company voluntarily fully funded the tax-

qualified portion of the PPP, as measured by its accumulated

benefit obligation, through a contribution of cash and IBM

stock totaling $3,963 million in the fourth quarter of 2002.

These assumption changes and funding action had the col-

lective net effect of causing the reduction in the Retirement-

related plans—cost/(income) amount displayed on page 54.

See the Looking Forward section on page 64 for the impact

of assumption changes on the 2004 Retirement-related

plans—cost/(income). Also see pages 110 to 117 for addi-

tional information relating to the company’s retirement-

related plans including assumptions and method used to

determine assumptions.

Provision for Income Taxes

The provision for income taxes resulted in an effective tax

rate of 30.0 percent for 2003, compared with the 2002 effec-

tive tax rate of 29.1 percent. The increase in the effective tax

rate in 2003 versus 2002 was primarily due to a less favorable

mix of geographic income and the absence of the tax benefit

associated with the Microelectronics actions taken in the

second quarter of 2002.

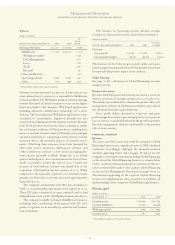

Weighted-Average Common Shares

YR. TO YR.

FOR THE YEAR ENDED DECEMBER 31: 2003 2002 CHANGE

Earnings per share from

continuing operations:

Assuming dilution $«««««4.34 $«««««3.07 41.4%

Basic 4.42 3.13 41.2

Weighted-average shares

outstanding: (in millions)

Assuming dilution 1,756.1 1,730.9 1.5%

Basic 1,721.6 1,703.2 1.1

The average number of common shares outstanding assuming

dilution was higher by 25.2 million shares in 2003 versus

2002. The increase was primarily the result of the company’s

use of common shares to fund a portion of its fourth quarter

2002 contribution to the PPP and common shares associated

with the acquisition of PwCC, partially offset by the

company’s common share repurchase program. See note N,

“Stockholders’ Equity Activity,” on pages 100 and 101 for

additional information regarding the common share activities.

Also see note T, “Earnings Per Share of Common Stock,” on

page 108.

SEGMENT DETAILS

The following is an analysis of the 2003 versus 2002 external

segment results. The analysis of 2002 versus 2001 external

segment results is on pages 61 and 62.

Global Services

(dollars in millions)

YR.

TO YR.

FOR THE YEAR ENDED DECEMBER 31: 2003 2002*CHANGE

Global Services Revenue: $«42,635 $«36,360 17.3%

Strategic Outsourcing $«17,124 $«14,995 14.2%

Business Consulting 12,955 9,424 37.5

Integrated Technology 7,099 6,871 3.3

Maintenance 5,457 5,070 7.6

*Reclassified to conform with 2003 presentation.

Global Services revenue increased 17.3 percent (9.3 percent

at constant currency) in 2003 versus 2002. SO revenue

increased in 2003 primarily driven by new signings. SO con-

tinued to demonstrate its competitive advantage in delivering

on demand solutions by leveraging its business transformation

skills and its scale during 2003. e-business Hosting Services,

an offering that provides Web infrastructure and application

management as an Internet-based service, continued its

strong pattern of revenue growth. BCS revenue increased in

2003 due to the acquisition of PwCC in the fourth quarter of

2002. ITS revenue increased due to the favorable impact of

currency movements. During 2003, the company changed its

reporting for certain OEM hardware sales to IBM clients

from gross to net revenue treatment based upon a review of

the terms of these sales. The company determined that the

agent-like characteristics of these transactions were more

appropriately recorded on a net revenue basis. Due to the

amounts involved, the prior year amounts were not adjusted.

As a result of this change in 2003, revenue and costs for ITS

were lower by $279 million in 2003 as compared to 2002,

partially offsetting the currency impact discussed above.

This change had no impact on the company’s gross profit

dollars, net income or cash flows.

Management Discussion

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

55

(dollars in millions)

YR. TO YR.

FOR THE YEAR ENDED DECEMBER 31: 2003 2002 CHANGE

Global Services:

Gross profit $«10,732 $«9,548 12.4%

Gross profit margin 25.2% 26.3% (1.1) pts.