IBM 2003 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2003 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

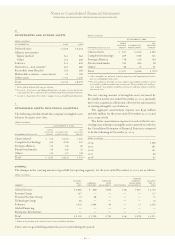

(dollars in millions, net of tax) DEBIT/(CREDIT)

Cumulative effect of adoption of

SFAS No. 133 as of January 1, 2001 $«(219)

Net gains reclassified into earnings

from equity during 2001 379

Changes in fair value of derivatives in 2001 (456)

December 31, 2001 (296)

Net losses reclassified into earnings from

equity during 2002 (5)

Changes in fair value of derivatives in 2002 664

December 31, 2002 363

Net losses reclassified into earnings

from equity during 2003 (713)

Changes in fair value of derivatives in 2003 804

December 31, 2003 $««454

At December 31, 2003, there were no significant gains or

losses on derivative transactions or portions thereof that were

either ineffective as hedges, excluded from the assessment

of hedge effectiveness, or associated with an underlying

exposure that did not occur; nor are there any anticipated in

the normal course of business.

M

other liabilities

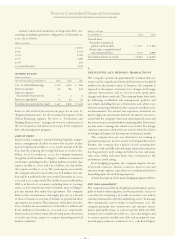

(dollars in millions)

AT DECEMBER 31: 2003 2002*

Deferred taxes $«1,834 $«1,450

Deferred income 1,842 1,409

Executive compensation accruals 1,036 851

Restructuring actions 871 1,024

Postemployment/preretirement liability 579 572

Disability benefits 349 304

Environmental accruals 214 208

Other 731 463

Total $«7,456 $«6,281

*Reclassified to conform with 2003 presentation.

Each year the company takes certain workforce rebalancing

actions to improve productivity and competitive position. The

non-current contractually obligated future payments associ-

ated with these ongoing activities are reflected in the Post-

employment/preretirement liability caption in the table above.

In addition, the company executed certain actions prior

to 1994, and in 1999 and 2002. The non-current liabilities

associated with these actions are reflected in restructuring

actions in the following table. The reconciliation of the

December 31, 2002 to 2003 balances of the current and non-

current liabilities for restructuring actions are presented in the

tables on pages 105 and 107. The current liabilities presented in

the table are included in Other accrued expenses and liabilities

in the Consolidated Statement of Financial Position.

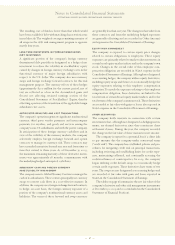

(dollars in millions)

BALANCE AT OTHER BALANCE AT

JAN. 1, ADJUST- DEC. 31,

2003 PAYMENTS MENTS*2003

Current:

Workforce $««««647 $«537 $««112 $«222

Space 181 229 177 129

Other 115 90 14 39

Total $««««943 $«856 $««303 $«390

Non-current:

Workforce $««««574 $«««— $««««13 $«587

Space 419 — (137) 282

Other 31 — (29) 2

Total $«1,024 $«««— $«(153) $«871

*The other adjustments column in the table above includes the reclassification of non-

current to current and foreign currency translation adjustments. In addition, net adjust-

ments of approximately $106 million were made during the year ended December 31,

2003 to reduce previously recorded liabilities. These adjustments were for differences

between the estimated and actual proceeds on the disposition of certain assets and

changes in the estimated cost of employee terminations and vacant space for the 2002

actions ($28 million), net adjustments for fourth quarter 2002 actions recorded in pur-

chase accounting ($36 million), HDD-related restructuring in 2002 ($20 million) and

actions prior to 1999 ($22 million). Of the $106 million of net adjustments, $36 million

was recorded as adjustments to Goodwill, $20 million was included in Discontinued

Operations (for the HDD related restructuring actions), with the remainder predomi-

nantly included in SG&A in the Consolidated Statement of Earnings.

The workforce accruals primarily relate to the company’s

Global Services business. The non-current portion of the

liability relates to terminated employees who are no longer

working for the company, but who were granted annual pay-

ments to supplement their incomes in certain countries.

Depending on the individual country’s legal requirements,

these required payments will continue until the former

employee begins receiving pension benefits or dies. Included

in the December 31, 2003 workforce accruals above is $133 mil-

lion associated with the HDD related restructuring discussed

in note C, “Acquisitions/Divestitures,” on pages 89 to 92.

The space accruals are for ongoing obligations to pay rent

for vacant space that could not be sublet or space that was

sublet at rates lower than the committed lease arrangement.

The length of these obligations varies by lease with the

longest extending through 2016.

Other accruals are primarily the remaining liabilities

(other than workforce or space) associated with the 2002

second quarter actions described in note S, “2002 Actions,”

on pages 105 through 107. In addition, there are $7 million of

remaining liabilities at December 31, 2003 associated with

the HDD-related restructuring discussed in note C,

“A cquisitions/Divestitures,” on pages 89 to 92.

The company employs extensive internal environmental

protection programs that primarily are preventive in nature.

The company also participates in environmental assessments

and cleanups at a number of locations, including operating

facilities, previously owned facilities and Superfund sites.

The total amounts accrued for environmental liabilities,

including amounts classified as current in the Consolidated

Statement of Financial Position, that do not reflect actual

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

99