IBM 2003 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2003 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

CHAIRMAN’S LETTER

strengthen our portfolio. And we were able to return

$5.4 billion to investors—$4.3 billion through share

repurchase and $1.1 billion through dividends—ending

the year in a strong cash position, with $7.6 billion,

including marketable securities.

Overall, despite facing serious challenges, the IBM

team executed with discipline. And indications for the

year ahead are encouraging, including a strong demand

pipeline (enlarged by more than $17 billion of services

signings in the fourth quarter) and a growing number

of alliances with business partners and software

companies committed to leading with IBM’s open,

standards-based platforms.

All in all, a very good performance. But is it sustain-

able? Can we, in fact, improve upon it and keep grow-

ing for the foreseeable future? I believe so, and let me

tell you why.

Recommitting to high value

For the past couple of decades, if you were to look at

IBM’s performance in any given year or over several

years, what would you see? You’d see a very large global

company in which some businesses are growing rapidly,

some are flat and some are declining. Add it up, and it

would average out to steady profitability—but perhaps

uninspiring growth. For people with comparatively

short memories, this might be the only IBM they’d

ever known. And it would be legitimate to ask if the

company is capable of more.

The answer is: We certainly are. In fact, over most

of our nearly 100-year history, IBM was consistently

a company that outperformed others in our markets

and generated superior returns. And that was because

we were singularly focused on leading, and most

often creating and defining, the high-value spaces

in our industry.

Of course, with a company of IBM’s breadth and

global presence, there are always ups and downs that

result from economic cycles, product and technology

transitions, and sometimes issues of execution. But

it’s also apparent that, somewhere along the line, we

became more focused on defending our existing lead-

ership position than on creating the next one. We

weren’t particularly bold or imaginative in getting into

new markets or developing new businesses, products

and services, even when our strategic analyses indicat-

ed that something new was coming. And, just as

important, we hesitated to reinvent or get out of busi-

nesses that no longer represented high value for either

clients or shareholders. In a word, we lost sight of

IBM’s mission, of what had always set us apart.

We l l, we’ve regained our focus now. IBM is an inno-

vator—in every dimension of that word. We know that

IBM and IBMers are at their best when they create

value that our clients cannot get from anyone else.

That means we will provide leading-edge technology,

services, expertise and intellectual capital, and will

integrate these capabilities for each client to provide

them with competitive advantage.

We commit to that. We commit to innovating to

deliver client success. And that is something for which

clients are willing to pay a premium.

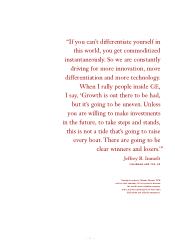

This may seem like a truism, but it actually commits

us to a very focused strategy, based on a choice between

the two primary sources of growth and profit in IT

today: the high-volume, undifferentiated product

play; and the high-value, innovation and integration

play, focused on the enterprise. It is this high-value

space we have chosen to lead.

We believe this is the right choice for IBM and our

investors. By focusing on this space, we believe we can,

on a sustainable, long-term basis, generate superior

returns compared to the overall IT industry, command

leading share position in our selected businesses, out-

perform the average of the S&P 500 on return on

invested capital, and produce strong cash flows.

In recent years, we’ve taken many steps to seize this

position. Before I talk about those steps, I want to spend

a minute on what constitutes “high value” for clients

today, and what will do so for the foreseeable future. It’s

embodied in what we call the on demand enterprise.

And that, in turn, is all about a new kind of integration.

The next wave of integration

After two decades of disaggregation, the IT industry

is re-integrating. This is being driven simultaneously

by a major shift in client demand, and a major shift

in technology.

Companies have come to realize that if they’re

going to respond rapidly and effectively to today’s

volatile marketplace, they need to do more than

Web-enable discrete systems, processes or business

units. They need to pull together all of the systems

they’ve already got and integrate them securely with

their core business activities—horizontally, across

not just their whole company but their entire value

chain, from customers to suppliers. This is an

on demand enterprise.