IBM 2003 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2003 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Customer participation rates are the propensity of IBM’s

clients to finance their purchases through Global Financing

in lieu of paying IBM up-front cash.

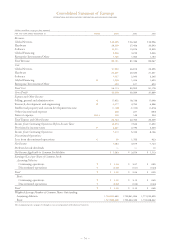

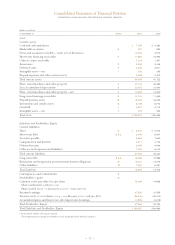

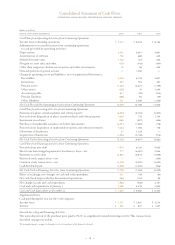

RESULTS OF OPERATIONS

(dollars in millions)

FOR THE YEAR ENDED DECEMBER 31: 2003 2002 2001

External revenue $«2,827 $«3,203 $«3,407

Internal revenue 1,300 939 836

Total revenue 4,127 4,142 4,243

Cost 1,846 1,803 2,016

Gross profit $«2,281 $«2,339 $«2,227

Gross profit margin 55.3% 56.5% 52.5%

Pre-tax income $«1,182 $««««955 $«1,143

After-tax income $««««766 $««««627 $««««727

Return on equity*22.3% 17.2% 18.4%

*Return on equity is calculated using a five-point average of equity and an estimated tax

rate principally based on Global Financing’s geographic mix of earnings, as IBM’s

provision for income taxes is determined on a consolidated basis. See page 55 for the

IBM consolidated tax rate.

Global Financing revenue was flat in 2003 as compared to

2002. External revenue decreased 11.7 percent (18 percent at

constant currency) in 2003 versus 2002 driven by lower

financing income, due to declining interest rates and a lower

average asset base, and a decrease in external used equip-

ment sales. The lower average asset base was primarily due to

lower originations in prior years. Internal revenue increased

38.4 percent in 2003 versus 2002 driven by internal used

equipment sales, primarily zSeries. Global Financing remar-

kets used equipment, primarily resulting from returns off of

lease, both externally and internally. Externally remarketed

equipment represents sales to clients and resellers, while

internally remarketed equipment primarily represents used

equipment that is sold internally and then remarketed exter-

nally through the Hardware segment.

Global Financing revenue decreased 2.4 percent in 2002

versus 2001. The decrease in external revenue was driven

by lower financing income due to a lower average asset base

discussed above partially offset by an increase in external

used equipment sales. The decline in external revenue was

offset by an increase in internal revenue due to an increase in

internal used equipment sales. See discussion above.

Global Financing gross profit dollars decreased 2.5 percent

and the gross profit margin declined 1.2 points in 2003 versus

2002. The decrease in gross profit dollars was primarily

driven by declining interest rates and a lower average asset

base discussed above partially offset by improved financing

margins. The decrease in gross profit margin was driven by a

mix change towards lower margin remarketing sales and away

from financing income partially offset by lower borrowing

costs related to the current interest rate environment.

Global Financing gross profit dollars increased 5.0 percent

and the gross profit margin increased 4.0 points in 2002 versus

2001. The increases in 2002 gross profit dollars and gross

profit margin were primarily driven by lower borrowing costs.

Global Financing pre-tax income increased 23.8 percent

in 2003 versus 2002, following a decrease of 16.4 percent in

2002 versus 2001. The increase in 2003 was driven by a

decrease in bad debt expense partially offset by a decrease in

gross profit discussed above. The decrease in bad debt expense

is reflective of the improved general economic environment

and reduced exposure in specific sectors, particularly the

Communications sector. (Also see pages 71 and 72 for an

additional discussion of Global Financing Receivable

Allowance for Doubtful Accounts.) The decrease in 2002

versus 2001 was due to increases in provisions for bad debt

reflective of the general economic environment as well as

specific client issues, such as the Communications sector,

partially offset by an increase in gross profit discussed previously.

The increase in return on equity from 2002 to 2003 was

due to higher earnings primarily associated with a decrease

in provisions for bad debt expense. The decrease in return

on equity from 2001 to 2002 was due to lower earnings asso-

ciated with an increased provision for bad debt expense.

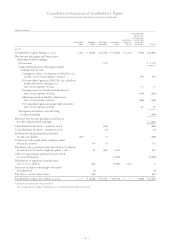

FINANCIAL CONDITION

Balance Sheet

(dollars in millions)

AT DECEMBER 31: 2003 2002

Cash $««««««813 $«««1,157

Net investment in sales-type leases 11,969 12,314

Equipment under operating leases:

External customers 1,707 1,922

Internal customers(a)(b) 1,873 1,701

Customer loans 10,413 9,621

Total customer financing assets 25,962 25,558

Commercial financing receivables 5,835 5,525

Intercompany financing

receivables(a)( b) 1,999 1,616

Other receivables 270 445

Other assets 1,037 941

Total financing assets $«35,916 $«35,242

Intercompany payables(a) $«««6,754 $«««5,383

Debt(c) 23,264 23,828

Other liabilities 2,546 2,556

Total financing liabilities 32,564 31,767

Total financing equity 3,352 3,475

Total financing liabilities and equity $«35,916 $«35,242

(a) Amounts eliminated for purposes of IBM’s consolidated results and therefore do not

appear on page 75.

(b)These assets, along with the other assets in this table, are leveraged using Global

Financing debt.

(c) Global Financing debt includes debt of the company and of the Global Financing units

that support the Global Financing business.

Sources and Uses of Funds

The primary use of funds in Global Financing is to originate

customer and commercial financing assets. Customer

financing assets for end users consist primarily of IBM hard-

ware, software and services, but also include non-IBM equip-

Management Discussion

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

70