IBM 2003 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2003 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

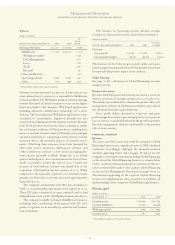

The company’s Systems Group revenue grew 17.5 percent

(8 percent at constant currency) driven by zSeries main-

frames and xSeries servers. zSeries revenue increased due to

the successful introduction of the z990 products that

include additional memory capabilities, I/O channels,

processors and secure-key cryptography. zSeries volumes

increased 62 percent as measured in MIPS compared to the

2002 fourth quarter. xSeries revenues increased due to the

company’s successful blade strategy. Increased demand

drove higher revenue for pSeries and Storage. iSeries rev-

enue was generally flat.

Technology Group revenue declined 19.5 percent (20 per-

cent at constant currency) primarily driven by the impact of

divestitures in 2002. Personal Systems Group revenue

increased 15.9 percent (8 percent at constant currency) due

primarily to higher demand for personal computers, particu-

larly mobile products, as increased volumes more than offset

reductions in prices.

Software revenue increased 11.8 percent (2 percent at

constant currency) primarily due to continued strength in

demand for WebSphere, DB2Database and Tivoli middle-

ware products, as well as the acquisition of Rational.

Rational, acquired during the 2003 first quarter, surpassed

expectations and yielded 28 percent revenue growth over its

separately reported results for the 2002 fourth quarter.

Operating system revenue increased due to the favorable

impact of currency movements.

Global Financing revenue declined 11.5 percent (18 percent

at constant currency) due primarily to lower interest rates

and a lower average asset base. Given the unit’s annuity-like

business, lower originations in years prior to 2003 resulted in

lower revenue in 2003.

The company’s gross profit margin declined slightly and

was driven by declines in Global Services, Hardware and

Global Financing, partially offset by Software. In Global

Services, a 1.5 point decline was due to continued price pres-

sures given current industry demand, higher investment

costs associated with the early stages of an SO contract, and

the rescoping of several outsourcing contracts. In Hardware,

margins were flat in Systems Group and up in Technology

Group, offset by a 3 point decline in the Personal Systems

Group driven by increased warranty costs associated with

desktop products and industry-wide price declines. The

decline in Global Financing margins of 3 points was driven by

a mix change toward lower margin remarketing sales away

from financing income.

The decline in the company’s Total expense and other

income was due to the $574 million pre-tax charge primarily

associated with the fourth quarter 2002 acquisition of PwCC.

This decline was partially as offset by increases in expenses

attributable to the newly acquired businesses (primarily

Rational). The company’s expense-to-revenue ratio improved

by 3.9 points, of which 2.4 points were associated with the

absence in the 2003 fourth quarter of the pre-tax charge that

was incurred in the 2002 fourth quarter. The remaining

1.5 point improvement is associated with additional produc-

tivity and efficiency initiatives partially offset by the

increased expenses associated with the acquired businesses.

On specific expense items, retirement-related plans resulted

in $169 million of additional expense in the 2003 fourth

quarter due to the net impact of assumption changes and

contributions at year end 2002. The provision for doubtful

accounts was $144 million lower in the 2003 fourth quarter

due to the stabilization of the general economy and

specific client issues over the past twelve months.

The company’s 2003 fourth quarter effective tax rate

was 30.0 percent as compared to 29.5 percent in the 2002

fourth quarter.

Share repurchases totaled approximately $3.1 billion in

the fourth quarter. The weighted-average number of diluted

common shares outstanding in the quarter was 1,745.7 billion

compared with 1,728.7 billion in the 2002 fourth quarter,

higher by 17.0 million shares. The increased amount of

shares was driven primarily by additional diluted shares

related to the company’s higher share price compared with

the prior-year period, and additional shares issued in con-

junction with the company’s acquisition of PwCC and the

funding for the company’s PPP in the fourth quarter 2002,

offset by the company’s ongoing common share repurchase

program in the fourth quarter of 2003.

The company generated higher cash flows from opera-

tions in the 2003 fourth quarter as compared to the 2002

fourth quarter primarily due to the strong financial results

described above, as well as lower pension funding in the fourth

quarter of 2003 as compared to the fourth quarter of 2002.

The company also reduced capital expenditures as it com-

pletes the 300 millimeter semiconductor facility. Finally, the

company repurchased $3,069 million in shares during the

2003 fourth quarter ($3,010 million was settled in cash and

the remainder was reflected in accounts payable and will be

settled in 2004). This compared with $74 million in shares

repurchased during the 2002 fourth quarter.

Management Discussion

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

60