IBM 2003 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2003 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

The increase in the Software gross profit dollars and gross

profit margin was primarily driven by the growth in Software

revenue and the positive impact from currency.

Global Financing

See page 70 for a discussion of Global Financing’s revenue

and gross profit.

Enterprise Investments

Revenue from Enterprise Investments increased 4.2 percent

(down 5.1 percent at constant currency) in 2003 versus 2002.

The decline was attributable to demand for product life-cycle

management software in the European market, especially in

the automotive and aerospace industries.

Gross profit dollars increased 12.9 percent and gross

profit margin increased 3.4 percentage points to 43.6 percent

in 2003 versus 2002 primarily driven by the growth in product

life-cycle management software attributable to the positive

effects from currency.

FINANCIAL POSITION

Dynamics

The assets and debt associated with the company’s Global

Financing business are a significant part of IBM’s financial

condition. Accordingly, although the financial position

amounts appearing below and on pages 58 and 59 are the

company’s consolidated amounts including Global Financing,

to the extent the Global Financing business is a major driver

of the consolidated financial position, reference in the nar-

rative section will be made to the separate Global Financing

section in this Management Discussion on pages 69 to 73.

The amounts appearing in the separate Global Financing

section are supplementary data presented to facilitate an

understanding of the company’s Global Financing business.

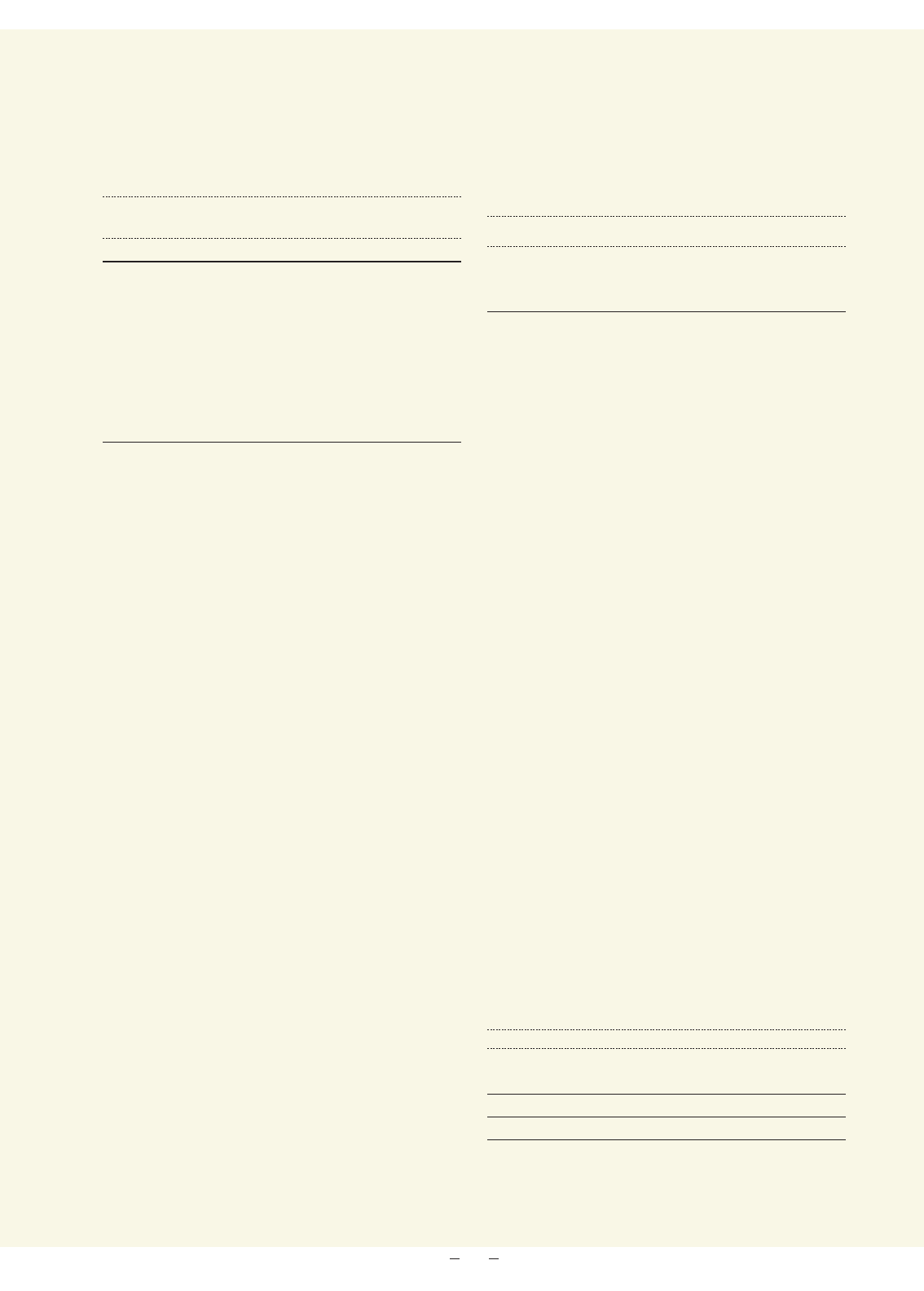

Working Capital

(dollars in millions)

AT DECEMBER 31: 2003 2002*

Current assets $«44,998 $«41,722

Current liabilities 37,900 34,220

Working capital $«««7,098 $«««7,502

Current ratio 1.19:1 1.22:1

*Reclassified to conform with 2003 presentation.

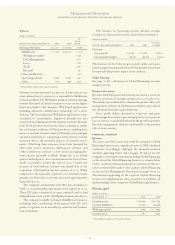

Software

(dollars in millions)

YR.

TO YR.

FOR THE YEAR ENDED DECEMBER 31: 2003 2002*CHANGE

Software Revenue: $«14,311 $«13,074 9.4%

Middleware $«11,242 $«10,117 11.1%

WebSphere family 11.8

Data Management 4.7

Lotus 0.9

Tivoli 12.0

Rational NA

Other middleware 5.5

Operating systems 2,450 2,307 6.2

Other 619 650 (4.7)

*Reclassified to conform with 2003 presentation.

Software revenue increased 9.4 percent (1.9 percent at con-

stant currency) in 2003 versus 2002, especially for Middleware

software products. The WebSphere family of software offerings

revenue increased as clients continue to focus on the higher

function products that integrate Web-based applications,

including advanced collaboration technology, on a user’s

desktop. The lower-function WebSphere application server

continued to commoditize. Improved demand was also

noted for Data Management DB2database software. Revenue

from Tivoli products increased as clients continue to realize

the on demand attributes of Tivoli products, enabling busi-

nesses to securely automate many of their processes and gain

operational efficiencies. Operating system software revenue

increased due to the favorable impacts of currency move-

ments. Offsetting these increases were lower demand for

DB2tools, Lotus advanced collaboration software and

Other middleware software. A new Lotus messaging plat-

form became generally available during the 2003 fourth

quarter and helped to drive momentum in the Lotus Notes

family of products toward the end of 2003. Overall, the

increase in total Software revenue was mainly due to the

acquisition of Rational in the first quarter of 2003. When

compared to the separately reported 2002 external revenue

amounts for Rational, its revenue increased approximately

6 percent in 2003.

The company’s momentum with ISVs has continued to

build as 155 partnership agreements were signed in 2003.

These ISVs have committed to open standards and to lead

with platforms such as DB2, WebSphere, Linux and eServer.

The company is rapidly evolving its Middleware business,

including sales, marketing, development and ISV pro-

grams, to a greater focus on industry solutions and business

transformations.

Management Discussion

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

The increase in Operating system software revenue

correlates to the increases in the related eServer increases.

(dollars in millions)

YR. TO YR.

FOR THE YEAR ENDED DECEMBER 31: 2003 2002 CHANGE

Software:

Gross profit $«12,384 $«11,031 12.3%

Gross profit margin 86.5% 84.4% 2.1pts.