IBM 2003 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2003 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

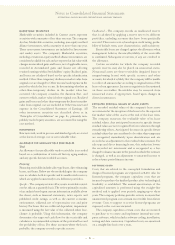

PRODUCT WARRANTIES

The company estimates its warranty costs based on historical

warranty claim experience and applies this estimate to the

revenue stream for products under warranty. Included in the

company’s warranty accrual are costs for limited warranties

and extended warranty coverage. Future costs for warranties

applicable to revenue recognized in the current period are

charged to cost of revenue. The warranty accrual is reviewed

quarterly to verify that it properly reflects the remaining

obligation based on the anticipated expenditures over the

balance of the obligation period. Adjustments are made when

actual warranty claim experience differs from estimates.

COMMON STOCK

Common stock refers to the $.20 par value capital stock as

designated in the company’s Certificate of Incorporation.

Treasury stock is accounted for using the cost method.

When treasury stock is reissued, the value is computed and

recorded using a weighted-average basis.

EARNINGS PER SHARE OF COMMON STOCK

Earnings per share of common stock-basic is computed by

dividing Net income applicable to common stockholders by

the weighted-average number of common shares outstanding

for the period. Earnings per share of common stock-assuming

dilution reflects the maximum potential dilution that could

occur if securities or other contracts to issue common stock

were exercised or converted into common stock and would

then share in the net income of the company. See note T,

“Earnings Per Share of Common Stock,” on page 108 for

additional information.

B

accounting changes

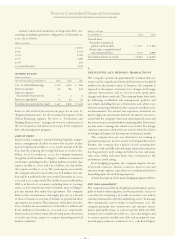

STANDARDS IMPLEMENTED

In December 2003, the FASB revised SFAS No. 132,

“Employers’ Disclosures about Pensions and other Post-

retirement Benefits, an amendment of FASB Statements

No. 87, 88 and 106.” This new SFAS No. 132 retains all of the

disclosure requirements of SFAS No. 132; however, it also

requires additional annual disclosures describing types of

plan assets, investment strategy, measurement date(s),

expected employer contributions, plan obligations, and

expected benefit payments of defined benefit pension plans

and other defined benefit postretirement plans. In accor-

dance with the transition provisions of SFAS No. 132 (revised

2003), note W, “Retirement-Related Benefits,” on pages 110

through 117 has been expanded to include the new disclo-

sures required as of December 31, 2003.

In January 2003, the FASB issued FIN 46, “Consolidation

of Variable Interest Entities,” which addresses consolidation

by business enterprises of VIEs that either: (1) do not have

sufficient equity investment at risk to permit the entity to

finance its activities without additional subordinated financial

support, or (2) have equity investors that lack an essential

characteristic of a controlling financial interest.

Throughout 2003, the FASB released numerous proposed

and final FASB Staff Positions (FSPs) regarding FIN 46,

which both clarified and modified FIN 46’s provisions. In

December 2003, the FASB issued Interpretation No. 46

(FIN 46-R), which will replace FIN 46 upon its effective

date. FIN 46-R retains many of the basic concepts introduced

in FIN 46; however, it also introduces a new scope exception

for certain types of entities that qualify as a “business” as

defined in FIN 46-R, revises the method of calculating

expected losses and residual returns for determination of the

primary beneficiary, includes new guidance for assessing

variable interests, and codifies certain FSPs on FIN 46.

Pursuant to the transition requirements of FSP FIN 46-6,

the company previously disclosed in the third quarter 2003

Form 10-Qthe planned adoption of the consolidation guid-

ance applicable to existing VIEs as of December 31, 2003. In

accordance with the transition requirements of FIN 46-R,

the company has applied the provisions of FIN 46 as of

December 31, 2003, to all special-purpose entities (SPEs) as

defined within FIN 46-R to which it is associated and all non-

SPEs created after January 31, 2003. It will defer adoption of

FIN 46-R for all other non-SPEs until March 31, 2004.

The application of FIN 46 to VIEs created after January

31, 2003, did not result in any entities requiring consolida-

tion that would not already have required consolidation

under the voting equity interest model. Additionally, no new

consolidation was required as a result of applying FIN 46 to

the company’s SPEs. The company’s program to sell state and

local government receivables, as described in note J, “Sale

and Securitization of Receivables,” on page 95, involves

qualifying SPEs, and therefore is not subject to FIN 46. The

company is continuing to evaluate the impact of FIN 46-R

and its related guidance for its adoption as of March 31,

2004. However, it is not expected to have a material impact

on the company’s Consolidated Financial Statements.

In 2003, the Emerging Issues Task Force (EITF) reached

a consensus on two issues relating to the accounting for

multiple-element arrangements: Issue No. 00-21, “Accounting

for Revenue Arrangements with Multiple Deliverables,” and

Issue No. 03-05, “Applicability of AICPA SOP 97-2 to Non-

Software Deliverables in an Arrangement Containing More

Than Incidental Software.” The consensus opinion in EITF

No. 03-05 clarifies the scope of both EITF 00-21 and State-

ment of Financial Position (SOP) 97-2, “Software Revenue

Recognition,” and was reached on July 31, 2003. The transi-

tion provisions allow either prospective application or a

cumulative effect adjustment upon adoption. IBM adopted

the Issue prospectively as of July 1, 2003. EITF Nos. 00-21 and

03-05 did not have a material impact on the Consolidated

Financial Statements.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

86