IBM 2003 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2003 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

looking forward

The following key drivers impacting IBM’s business are

discussed on page 50:

•Economic environment and corporate IT spending budgets

for Enterprise Computing

•Internal business transformation and efficiency initiatives

•Technological innovations

•Open standards, including Linux

With respect to the economic environment, while it is always

difficult to predict future economic trends, year-end 2003

signals indicate that the IT industry has stabilized and the

next growth cycle in IT spending may be starting. The year-

to-year and sequential quarterly growth trend comparisons

achieved by the company are such signals (prior to considering

the positive year-to-year comparison benefits associated

with the acquisitions of PwCC and Rational).

With respect to business transformation and the contin-

ual conversion of IBM into an on demand business, the com-

pany’s supply chain initiatives are expected to allow

flexibility to drive additional competitive advantages. The

company will focus on expense management and additional

productivity initiatives with the aim of continuing to reduce

the company’s expense-to-revenue ratios.

Finally, with respect to technology, in 2003 the company

has again been awarded more U.S. patents than any other

company for the eleventh year in a row.

From a client-set perspective, the strong momentum in

2003 with respect to the Small & Medium Business sector

should continue while the Financial and Public sectors

should also continue to benefit from, among other things,

the company’s new z990 mainframes. The Communications,

Distribution and Industrial sectors may not grow as fast. The

company reorganized Global Services and Software to be

better aligned with the company’s industry sectors. This

change will foster an even greater ability to create industry-

specific solutions for clients.

From a Global Services perspective, the company finished

2003 with strong signings.

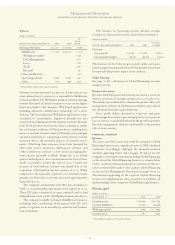

Global Services Signings

(dollars in millions)

FOR THE YEAR ENDED DECEMBER 31: 2003 2002 2001

Longer-term*$«34,608 $«33,068 $«32,016

Shorter-term*20,854 20,020 19,261

Total $«55,462 $«53,088 $«51,277

*Longer-term contracts generally 7 to 10 years in length and represent SO and BTO

contracts as well as BCS contracts with the U.S. federal government and its agencies.

Shorter-term contracts are generally 3 to 9 months in length and represent the remaining

BCS and ITS contracts.

The estimated Global Services backlog, including SO,

BCS, ITS and Maintenance, was $120 billion at December

31, 2003. Backlog estimates are subject to change and are

affected by several factors, including changes in scope of

contracts (mainly long-term contracts), periodic revalidations

and currency assumptions used to approximate constant

currency. Included in the numbers above are several

significant BTO contract signings within its BCS business.

These key competitive wins represent strong momentum in

the company’s goal to drive the BTO business into a

significant growth driver in the coming years.

To improve margins over the next year, the company is

targeting roughly a 4-point improvement in the utilization

rate of its consultants, optimizing the labor mix, and work-

ing to reduce overhead costs by 15 percent through addi-

tional productivity and efficiency initiatives.

The combination of the company’s Systems Group and

Technology Group, as discussed on page 118, will continue to

benefit the company’s ability to integrate key semiconductor

and other core technology innovations into solutions for

clients. The company continues to leverage its eServer

zSeries mainframe technology investments across its server

and storage portfolio. The ability to share elements of this

technology, such as security, automation and virtualization,

with the more commoditized platforms is a key competitive

advantage for IBM.

The Technology Group’s 2003 fourth quarter pre-tax loss

was less than that for the third quarter, even with lower IP

income. With the backdrop of meeting very strong demand

for the Systems Group’s key needs, the recent arrangement

with Microsoft to supply technology for its new Xbox system

and the continued growth of the relatively new E&TS business,

the company believes that its Microelectronics and E&TS

Divisions will continue to strongly benefit IBM’s other busi-

nesses and to continue the modest momentum that began in

the fourth quarter 2003.

Given the commoditized nature of the personal computer

industry, future results may be more volatile than in the com-

pany’s other businesses. The company’s internal surveys,

however, indicate that 57 percent of clients purchased IBM

personal computers due to unique IBM features such as

ThinkVantage technologies that often lower the cost to oper-

ate and maintain the machines. The company will attempt to

continue to build on these types of differentiating factors.

As for the company’s Software business, key to future

growth will be the continued leveraging of ISVs as an overall

business partner and an additional route to market. The new

Lotus workplace messaging platform became generally avail-

able in late November 2003 and received positive reaction

from both clients and industry analysts. Operating system

software growth will be dependent, in part, on the growth of

the underlying hardware sales.

See page 73 for forward-looking information regarding

Global Financing.

Management Discussion

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

63