IBM 2003 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2003 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

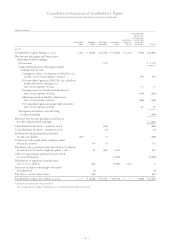

77

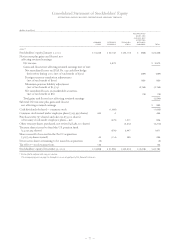

(dollars in millions)

ACCUMULATED

GAINS AND

(LOSSES) NOT

AFFECTING

COMMON RETAINED TREASURY RETAINED

STOCK EARNINGS STOCK EARNINGS TOTAL

2002*

Stockholders’ equity, January 1, 2002 $«14,248 $«30,142 $«(20,114) $««««(828) $«23,448

Net income plus gains and (losses) not

affecting retained earnings:

Net income 3,579 $«««3,579

Gains and (losses) not affecting retained earnings (net of tax):

Net unrealized losses on SFAS No. 133 cash flow hedge

derivatives during 2002 (net of tax benefit of $372) (659) (659)

Foreign currency translation adjustments

(net of tax benefit of $197) 850 850

Minimum pension liability adjustment

(net of tax benefit of $1,574) (2,765) (2,765)

Net unrealized losses on marketable securities

(net of tax benefit of $8) (16) (16)

Total gains and (losses) not affecting retained earnings (2,590)

Subtotal: Net income plus gains and (losses)

not affecting retained earnings $««««««989

Cash dividends declared—common stock (1,005) (1,005)

Common stock issued under employee plans (7,255,995 shares) 440 4 444

Purchases (189,797 shares) and sales (12,873,502 shares)

of treasury stock under employee plans—net (475) 1,311 836

Other treasury shares purchased, not retired (48,481,100 shares) (4,212) (4,212))

Treasury shares issued to fund the U.S. pension fund

(24,037,354 shares) (576) 2,447 1,871

Shares issued/to be issued in the PwCC acquisition

(3,677,213 shares issued) 43 (114) 355 284

Decrease in shares remaining to be issued in acquisition (9) (9)

Tax effect—stock transactions 136 136

Stockholders’ equity, December 31, 2002 $«14,858 $«31,555 $«(20,213) $«(3,418) $«22,782

*Reclassified to conform with 2003 presentation.

The accompanying notes on pages 80 through 121 are an integral part of the financial statements.

Consolidated Statement of Stockholders’ Equity

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES