IBM 2003 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2003 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

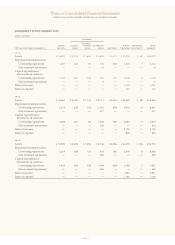

amended its postretirement plan to provide that new hires

will no longer be eligible for company-subsidized benefits.

Certain of the company’s non-U.S . subsidiaries have

similar plans for retirees. However, most of the retirees

outside the U.S. are covered by government-sponsored and

administered programs. The total cost of these plans for

the years ended December 31, 2003, 2002 and 2001, was

$41 million, $29 million and $28 million, respectively. At

December 31, 2003 and 2002, Other liabilities in the

Consolidated Statement of Financial Position include non-

U.S. postretirement benefit liabilities of $270 million and

$211 million, respectively.

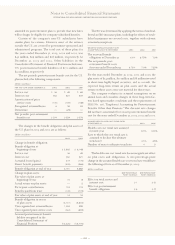

The net periodic postretirement benefit cost for the U.S.

plan includes the following components:

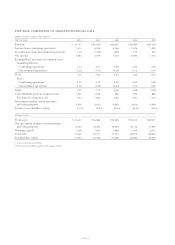

(dollars in millions)

FOR THE YEAR ENDED DECEMBER 31: 2003 2002 2001

Service cost $«««36 $«««49 $«««65

Interest cost 382 421 437

Amortization of prior

service costs (130) (147) (148)

Recognized actuarial losses 630 22

Divestiture —(29) —

Net periodic post-retirement

benefit cost $«294 $«324 $«376

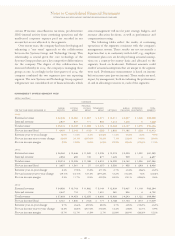

The changes in the benefit obligation and plan assets of

the U. S. plan for 2003 and 2002 are as follows:

(dollars in millions)

2003 2002

Change in benefit obligation:

Benefit obligation at

beginning of year $««5,882 $««6,148

Service cost 36 49

Interest cost 382 421

Actuarial losses/(gains) 419 (170)

Direct benefit payments (538) (566)

Benefit obligation at end of year 6,181 5,882

Change in plan assets:

Fair value of plan assets at

beginning of year 10 8

Actual return on plan assets —2

Participant contributions 153 119

Benefits paid from trust (149) (119)

Fair value of plan assets at end of year 14 10

Benefit obligation in excess

of plan assets (6,167) (5,872)

Unrecognized net actuarial losses 1,004 595

Unrecognized prior service costs (363) (493)

Accrued postretirement benefit

liability recognized in the

Consolidated Statement of

Financial Position $«(5,526) $«(5,770)

The BO was determined by applying the terms of medical,

dental and life insurance plans, including the effects of estab-

lished maximums on covered costs, together with relevant

actuarial assumptions.

WEIGHTED-AVERAGE DISCOUNT RATE

ASSUMPTIONS USED TO DETERMINE: 2003 2002 2001

The year-end benefit

obligation at December 31 6.0% 6.75% 7.0%

The net periodic post-

retirement benefit costs

for years ended December 31 6.75% 7.0% 7.25%

For the years ended December 31, 2003, 2002 and 2001, the

plan assets of $14 million, $10 million and $8 million invested

in short-term highly liquid securities, and as a result, the

expected long-term return on plan assets and the actual

return on those assets were not material for those years.

The company evaluates its actuarial assumptions on an

annual basis and considers changes in these long-term fac-

tors based upon market conditions and the requirements of

SFAS No. 106, “Employers’ Accounting for Postretirement

Benefits Other than Pensions.” The discount rate changes

did not have a material effect on net postretirement benefit

cost for the years ended December 31, 2003, 2002 and 2001.

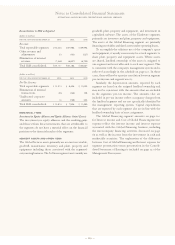

ASSUMED HEALTH CARE COST TREND RATES

AT DECEMBER 31: 2003 2002

Health care cost trend rate assumed

for next year 8.9% 10.0%

Rate to which the cost trend rate is

assumed to decline (the ultimate

trend rate) 4.5% 4.5%

Number of years to ultimate trend rate 45

The health care cost trend rate has an insignificant effect

on plan costs and obligations. A one-percentage-point

change in the assumed health care cost trend rate would have

the following effects as of December 31, 2003:

(dollars in millions)

ONE-PERCENTAGE- ONE-PERCENTAGE-

POINT INCREASE POINT DECREASE

Effect on total service and

interest cost $«1 $«(1)

Effect on postretirement

benefit obligation $«6 $«(7)

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

116