IBM 2003 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2003 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Purchase obligations include all commitments to purchase

goods or services of either a fixed or minimum quantity that

meet any of the following criteria: (1) they are noncancelable,

(2) the company would incur a penalty if the agreement was

cancelled, or (3) the company must make specified minimum

payments even if it does not take delivery of the contracted

products or services (“take-or-pay”). If the obligation to

purchase goods or services is noncancelable, the entire

value of the contract was included in the above table. If the

obligation is cancelable, but the company would incur a

penalty if cancelled, the dollar amount of the penalty was

included as a purchase obligation. Contracted minimum

amounts specified in take-or-pay contracts are also included

in the above table as they represent the portion of each con-

tract that is a firm commitment.

Events that could temporarily change the historical cash

flow dynamics discussed on page 64 include unexpected

adverse impacts from litigation or future pension funding

during periods of severe and prolonged downturns in the

capital markets. Whether any litigation has such an adverse

impact will depend on a number of variables, which are more

completely described on pages 101 and 102. With respect to

pension funding, the company is not quantifying such

impact because it is not possible to predict future timing or

direction of the capital markets. However, for 2004, if actual

returns on plan assets for the PPP were less than 5 percent,

the PPP’s accumulated benefit obligation (ABO) would be

greater than its Plan assets. As discussed on pages 110 to 115,

such a situation may result in a voluntary contribution of

cash or stock to the PPP or a charge to stockholders’ equity.

The following table depicts the company’s firm contrac-

tual commitments and must be reviewed within the context

of the discussion above. While these commitments may vary

from period to period and provide a view as to certain

unavoidable cash outflows, they represent a small picture of

the overall cash dynamics of the company in the table above.

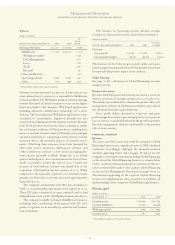

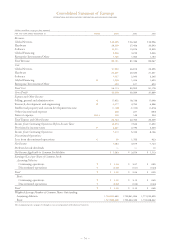

The table below represents the way in which management reviews its cash flow as described above.

(dollars in billions)

FOR THE YEAR ENDED DECEMBER 31: 1999 2000 2001 2002 2003

Net cash from operating activities (comprised of): $««9.0 $««8.8 $«14.0 $«13.8 $«14.6

Cash (from)/for Global Financing accounts receivable (1.7) (2.5) 2.0 3.3 1.9

Cash available for investment and for distribution

to shareholders 10.7 11.3 12.0 10.5 12.7

Net Global Financing receivables (2.3) (0.6) 0.9 0.2 (0.7)

Net capital expenditures (4.8) (4.3) (4.9) (4.6) (3.9)

Net divestitures/(acquisitions) 3.5 (0.3) (0.9) (2.0) (1.7)

Returns to shareholders (8.2) (7.6) (6.5) (5.2) (5.4)

Other 0.8 — 2.2 0.2 0.9

Net change in cash and cash equivalents $«(0.3) $«(1.5) $«««2.8 $««(0.9) $«««1.9

Management Discussion

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

65

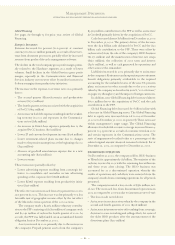

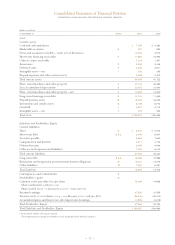

Contractual Obligations

(dollars in millions)

TOTAL

CONTRACTUAL

PAYMENT

PAYMENTS DUE IN

STREAM 2004 2005-06 2007-08 AFTER 2008

Long-term debt obligations $«19,343 $«4,061 $«««5,846 $«1,508 $«««7,928

Capital (Finance) lease obligations 58 11 27 6 14

Operating lease obligations 6,414 1,401 2,078 1,533 1,402

Purchase obligations 3,362 2,024 1,063 210 65

Other long-term liabilities:

Minimum pension funding (mandated)*1,212 220 564 428 —

Executive compensation 657 79 82 90 406

Environmental liabilities 243 29 32 28 154

Long-term termination benefits 2,627 487 396 260 1,484

Other 255 47 125 64 19

Total $«34,171 $«8,359 $«10,213 $«4,127 $«11,472

*These amounts represent future pension payments that are mandated by local regulations or statute. They are all associated with non-U.S. pension plans. The projected payments

beyond 2008 are not currently determinable. See note W, “Retirement-Related Benefits,” on pages 110 to 115 for additional information on the non-U.S. plans’ investment strategies

and expected contributions.