IBM 2003 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2003 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

The Global Services gross profit dollars increased primarily

due to the corresponding increase in revenue. The gross

profit margin declined due to investment costs on the early

stages of an SO contract and the company’s changing mix

toward BCS. These decreases in the gross profit margin were

partially offset by the benefit from the 2002 productivity

actions, as well as an increase in the gross margin for Main-

tenance, due to lower labor costs, as a result of improved

product serviceability and increased automation, as well as

lower parts costs.

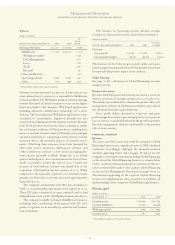

Hardware

(dollars in millions)

YR. TO YR.

PERCENT

FOR THE YEAR ENDED DECEMBER 31: 2003 2002 CHANGE

Hardware Revenue: $«28,260 $«27,630 2.3%

Systems Group $«14,002 $«12,646 10.7%

zSeries 7.4

iSeries 7.1

pSeries 12.5

xSeries 16.8

Storage Systems 9.8

Personal Systems Group 11,387 11,049 3.1

Personal Computers 3.5

Retail Store Solutions 9.3

Printer Systems (2.7)

Technology Group 2,871 3,935 (27.0)

Microelectronics (28.6)

Engineering &

Technology Services 65.6

Other (41.2)

Systems Group revenue increased 10.7 percent (3.3 percent

at constant currency) in 2003 versus 2002 driven by xSeries

server products due to growth in sales of high-volume

servers supported by strong growth in blades. The company

is now the industry leader in blade servers and just recently

announced the industry’s most powerful 4-way blade solution

at close to one-fourth the size of the competitors’ offerings. A

blade is an independent server with its own processors,

memory, storage, network controllers, operating system and

applications. Blade servers slide into the bays in a single

chassis, sharing power, fans, floppy drives, switches and

ports with other blade servers, thereby reducing the cost of

ownership by making it easier for clients to maintain the

machines. The pSeries server revenues increased due to

strong demand for the 64-bit POWER systems across both

the low-end and high-end server offerings. The company

expects to gain market share in both the xSeries and pSeries

server businesses.

Revenue from the zSeries servers increased. The total

delivery of zSeries computing power as measured in MIPS

increased more than 28 percent in 2003 as compared to

2002. This increase was offset by lower average price per

MIPS in 2003 versus 2002. The zSeries servers are often an

integral part of clients’ restructuring into an on demand

environment. Revenue from the iSeries servers increased in

all four quarters of 2003 when compared to 2002. An impor-

tant competitive differentiator for this platform is its ability

to consolidate and integrate heterogeneous workloads.

Storage Systems revenue increased due to growth in external

disk and tape products.

Personal Systems Group revenue increased 3.1 percent

(down 2.5 percent at constant currency) in 2003 versus 2002.

Revenue from mobile personal computers increased due to

strong demand and was offset by lower desktop personal

computer revenue. The decreased desktop revenue prima-

rily reflects the fact that increased volume gains were not

enough to offset a reduction in price due to decreasing com-

modity costs.

Technology Group revenue declined 27.0 percent

(27.5 percent at constant currency) in 2003 versus 2002

driven by actions taken in 2002 to refocus and redirect its

Microelectronics business to the high-end foundry, ASICs

and standard products, while creating a new technology

services business. These actions included the divestiture of

multiple non-core businesses. See pages 105 and 106 for addi-

tional information. There was also sluggish demand from

certain OEM clients that contributed to this decline. The

Technology Group’s advanced technologies provide the

Systems Group with a competitive advantage in performance

and cost, drivers for the Systems Group’s strong performance.

See page 118 for a discussion of the first quarter 2004 com-

bination of the Systems Group and the Technology Group.

Management Discussion

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

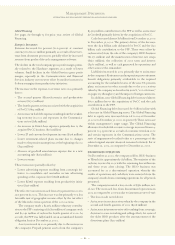

(dollars in millions)

YR. TO YR.

FOR THE YEAR ENDED DECEMBER 31: 2003 2002 CHANGE

Hardware:

Gross profit $«8,136 $«7,399 10.0%

Gross profit margin 28.8% 26.8% 2.0 pts.

Hardware gross profit dollars and gross profit margin

increased in 2003 versus 2002. The increases were primarily

driven by increases in Technology Group and Systems

Group, and a more favorable mix of revenue toward the

Systems Group, which has a higher gross profit margin than

the other Hardware groups. The increase in Technology

Group was primarily due to the productivity and cost savings

resulting from the 2002 Microelectronics actions taken in

the second quarter of 2002. The Systems Group gross margin

increases were due to improvements across most products,

as a result of improved component costs partly attributable

to the company’s supply chain initiatives and reduced inven-

tory losses.