IBM 2003 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2003 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

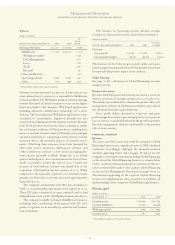

Costs to Complete Service Contracts

The company enters into numerous service contracts through

its SO and BCS businesses. SO contracts range for periods up

to ten years and BCS contracts can be for several years.

During the contractual period, revenue, cost and profits may

be impacted by estimates of the ultimate profitability of

each contract, especially contracts for which the company

uses the percentage-of-completion method of accounting.

See page 81 for the company’s services revenue recognition

accounting policies. If at any time, these estimates indicate

the contract will be unprofitable, the entire estimated loss

for the remainder of the contract is recorded immediately.

The company performs ongoing profitability analyses of

its services contracts in order to determine whether the latest

estimates require updating. Key factors reviewed by the

company to estimate the future costs to complete each

contract are future labor costs and productivity efficiencies.

To the extent actual estimated “to go” margins on percent-

age of completion services contracts differ from management’s

quarterly estimates by 1 percentage point, the company’s

consolidated net income would have improved/declined by

an estimated $35 million using 2003 results, depending upon

whether the actual results were higher/lower, respectively,

than the estimates. This amount excludes any accrual result-

ing from contracts in loss positions. For all long-term services

contracts that are either in a “to go” loss position or have an

estimated “to go” profit of 5 percent or less, if actual “to go”

costs were 5 percent greater than expected, the consolidated

net income would be reduced by an estimated $13 million.

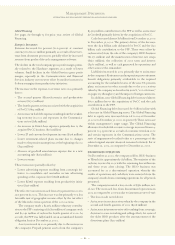

Net Realizable Value and Client Demand

The company reviews the net realizable value of and demand

for its inventory on a quarterly basis to ensure recorded

inventory is stated at the lower of cost or net realizable value

and that obsolete inventory is written off. Inventory at

higher risk for writedowns or write-offs are those in the

industries that have lower relative gross margins and that are

subject to a higher likelihood of changes in industry cycles.

The semiconductor and personal computer businesses are

two such industries.

Factors that could impact estimated demand and selling

prices are the timing and success of future technological

innovations and the economy.

To the extent that semiconductor and personal computer

inventory losses differ from management estimates by 5 per-

cent, the company’s consolidated net income in 2003 would

have improved/declined by an estimated $42 million using

2003 results, depending upon whether the actual results

were better/worse, respectively, than expected.

Warranty Claims

The company generally offers three-year warranties for its

personal computer products and one-year warranties on most

of its other products. The company estimates the amount and

cost of future warranty claims for its current period sales.

These estimates are used to record accrued warranty cost for

current period product shipments. The company uses his-

torical warranty claim information, as well as recent trends

that might suggest that past cost information may differ

from future claims.

Factors that could impact the estimated claim informa-

tion include the success of the company’s productivity and

quality initiatives, as well as parts and labor costs.

To the extent that actual claims costs differ from manage-

ment’s estimates by 5 percent, consolidated net income will

have improved/declined by an estimated $30 million in 2003,

depending upon whether the actual claims costs were

lower/higher, respectively, than the estimates.

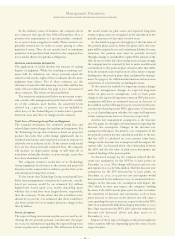

Income Taxes

The company is subject to income taxes in both the U.S. and

numerous foreign jurisdictions. Significant judgment is

required in determining the worldwide provision for income

taxes. During the ordinary course of business, there are many

transactions and calculations for which the ultimate tax

determination is uncertain. The company recognizes liabilities

for anticipated tax audit issues based on estimates of

whether additional taxes will be due. To the extent that the

final tax outcome of these matters is different from the

amounts that were initially recorded, such differences will

impact the income tax provision in the period in which such

determination is made.

To the extent that the provision for income taxes

increases/decreases by 1 percent of income from continuing

operations before income taxes, consolidated income from

continuing operations would have declined/improved by

$109 million in 2003.

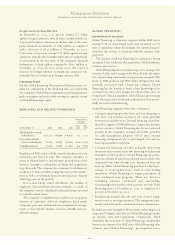

CURRENCY RATE FLUCTUATIONS

Changes in the relative values of non-U.S. currencies to the

U.S. dollar affect the company’s results. At December 31,

2003, currency changes resulted in assets and liabilities

denominated in local currencies being translated into more

dollars than at year-end 2002. The company uses a variety of

financial hedging instruments to limit specific currency

risks related to financing transactions and other foreign

currency-based transactions. Further discussion of currency

and hedging appears in note L, “Derivatives and Hedging

Transactions,” on pages 96 to 99.

Management Discussion

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

67