IBM 2003 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2003 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

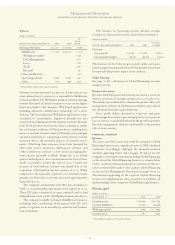

sg&a

(dollars in millions)

YR. TO YR.

FOR THE YEAR ENDED DECEMBER 31: 2003 2002 CHANGE

Selling, general and administrative expense:

Selling, general and administrative—base $«15,826 $«14,557 8.7%

Advertising 1,406 1,427 (1.5)

Wo rkforce reductions—ongoing 454 300 51.3

Bad debt 205 673 (69.5)

2002 actions (39) 1,489 NM NM

Acquisition-related charges—PwCC —292 NM NM

Total $«17,852 $«18,738 (4.7) %

NM—not meaningful

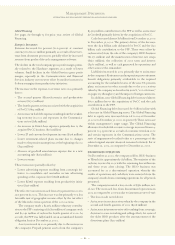

other (income) and expense

(dollars in millions)

YR. TO YR.

FOR THE YEAR ENDED DECEMBER 31: 2003 2002 CHANGE

Other (income) and expense:

Foreign currency transaction losses/(gains) $«411 $÷(39) NM NM

Interest income (152) (127) 19.7%

Net realized gains on sales of securities and other investments (54) (63) (14.3)

Writedowns of impaired investment assets 50 58 (13.8)

Net realized losses/(gains) from certain real estate activities 16 (66) (124.2)

2002 actions 2513 NM NM

Other (35) (49) (28.6)

Total $«238 $«227 5.0%

NM—not meaningful

Management Discussion

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

53

Total SG&A expense decreased 4.7 percent (9 percent at

constant currency) in 2003 primarily due to ongoing produc-

tivity and efficiency initiatives, including the related benefit

associated with the 2002 actions. In addition, the decrease

was due to the absence in 2003 of charges for the 2002

actions recorded in 2002. The 2002 actions, principally

workforce reductions, comprise the Microelectronics and

productivity actions taken in the second quarter of 2002 as

well as the fourth quarter 2002 actions related to the acqui-

sition of PwCC. See pages 105 through 107 for additional

information on the 2002 actions. In addition, Bad debt

expense declined in 2003 versus 2002 reflective of the

increased provision the company recorded in 2002 to reflect

the general economic environment as well as exposure in

specific sectors, particularly the Communications sector.

These issues have stabilized and contributed to the lower

year-to-year bad debt charges.

These decreases were partially offset by higher expenses

resulting from 2003 having a full year of expenses for PwCC

(acquired in the fourth quarter of 2002) and the expense asso-

ciated with Rational, which was acquired during the first

quarter of 2003. Included in these expenses is the amortization

of intangible assets relating to PwCC and Rational. Despite

these higher expenses associated with acquisitions, the

expense-to-revenue ratio for the SG&A-base category declined

from 2002 to 2003 (17.9 percent to 17.8 percent, respectively)

due, in part, to the benefits associated with the 2002 pro-

ductivity actions. The amount of Workforce reductions—

ongoing will vary from year to year depending upon needed

skills, the competitive landscape and economic conditions. The

2002 amount excludes workforce reductions that took place

in the second quarter of 2002. These 2002 second-quarter

workforce reductions were recorded in the 2002 actions

amount above. See note S, “2002 Actions,” on pages 105 to 107.

Other (income) and expense in 2003 versus 2002 was generally

flat. Foreign currency transaction losses/(gains) increased as

the dollar weakened against other currencies. This increase

was more than offset by the absence of 2002 actions, prin-

cipally losses associated with the exiting of a business and

the vacant space accruals in 2002. The foreign currency

transaction losses/ (gains) relate primarily to losses on certain

hedge contracts offset by gains on the settlement of foreign

currency receivables and payables. See pages 67 and 68 for

additional discussion of currency impacts on the company’s

financial results.