IBM 2003 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2003 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

•The selected reference to constant currency in the

Management Discussion is made so that the financial

results can be viewed without the impacts of changing for-

eign currency exchange rates and therefore facilitates a

comparative view of business growth.

Discontinued Operations

On December 31, 2002, the company sold its HDD business

to Hitachi, Ltd. (Hitachi). The HDD business was accounted

for as a discontinued operation under generally accepted

accounting principles (GAAP). This means that 2002 and 2001

income statement and cash flow information were reformatted

to separate the divested business from the company’s con-

tinuing operations. This presentation is required by GAAP

and facilitates historical and future trend analysis of IBM’s

continuing operations. On page 92, the company discusses

this transaction and the accounting for the divestiture.

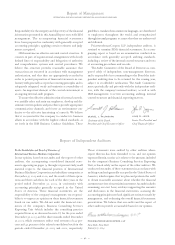

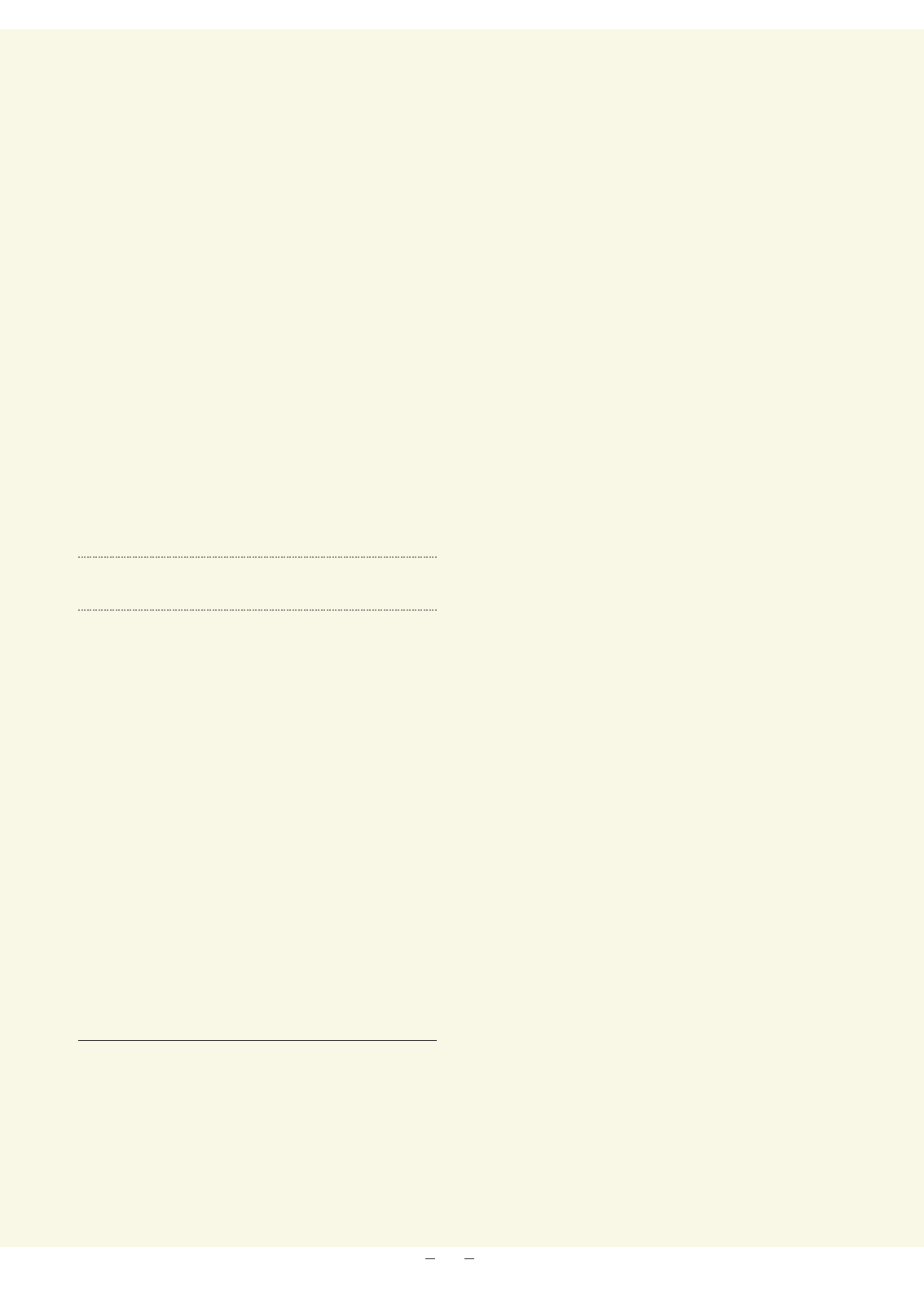

management discussion snapshot

(dollars and shares in millions except per share amounts)

YR. TO YR.

PERCENT/

MARGIN

FOR THE YEAR ENDED DECEMBER 31: 2003 2002 CHANGE

Revenue $«««89,131 $«81,186 9.8% *

Gross profit margin 37.0% 37.3% (0.3) pts.

Total expense and

other income $«««22,144 $«22,760 (2.7) %

Total expense and

other income to

revenue ratio 24.8% 28.0% (3.2) pts.

Provision for

income taxes $«««««3,261 $«««2,190 48.9%

Income from

continuing operations $«««««7,613 $«««5,334 42.7%

Earnings per share

from continuing

operations:

Assuming dilution $«««««««4.34 $«««««3.07 41.4%

Basic $«««««««4.42 $«««««3.13 41.2%

Weighted-average

shares outstanding:

Assuming dilution 1,756.1 1,730.9 1.5%

Basic 1,721.6 «1,703.2 1.1%

Assets** $«104,457 $«96,484 8.3%

Liabilities** $«««76,593 $«73,702 3.9%

Equity** $«««27,864 $«22,782 22.3%

*2.8 percent at constant currency

** at December 31

CONTINUING OPERATIONS

The increase in IBM’s 2003 Income from continuing oper-

ations and diluted earnings per share from continuing

operations as compared to 2002 was due to:

•The results of the company’s productivity and efficiency

initiatives, including the benefits from the 2002

Microelectronics and productivity actions

•Stronger demand associated with the improving economy

(especially during the fourth quarter) and continued mar-

ket share gains

•The charges recorded in 2002 for the 2002 actions

•Favorable impact of currency translation, partly offset by

related hedging activities

The increase in revenue in 2003 as compared to 2002 was

due to:

•Stronger demand associated with the improving economy

(especially during the fourth quarter) and continued market

share gains

•The impact of the fourth quarter 2002 acquisition of

PwCC and the first quarter 2003 acquisition of Rational,

partially offset by decreases in revenue due to Technology

Group divestitures

•The favorable impact from currency translation

With regard to the way that management reviews the busi-

ness, as-reported and constant currency revenue trends were

all positive for most of the company’s segments, geographies

and industry sectors. See page 51 for the summary trend rates

on an as-reported and constant currency basis, as well as such

information for each segment on pages 55 to 57.

Gross profit margins remained relatively flat. Increases in

Hardware and Software margins resulting from the ongoing

benefits from the company’s integrated supply chain initiatives

and favorable currency translation were offset by decreases

in Global Services margins driven primarily by investment

costs on the early stages of a Strategic Outsourcing (SO)

contract and the company’s changing mix of revenue toward

Business Consulting Services (BCS).

As discussed above, there were several charges in 2002

that impacted the year-to-year expense comparison. These

items contributed 2.8 points of the improvement in the Total

expense and other income-to-revenue ratio. The remaining

improvement was primarily due to the results of productivity

and efficiency initiatives partially offset by an increase in

retirement-related plans cost.

Management Discussion

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

44