IBM 2003 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2003 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

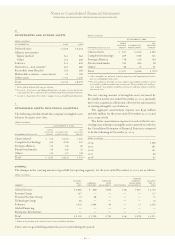

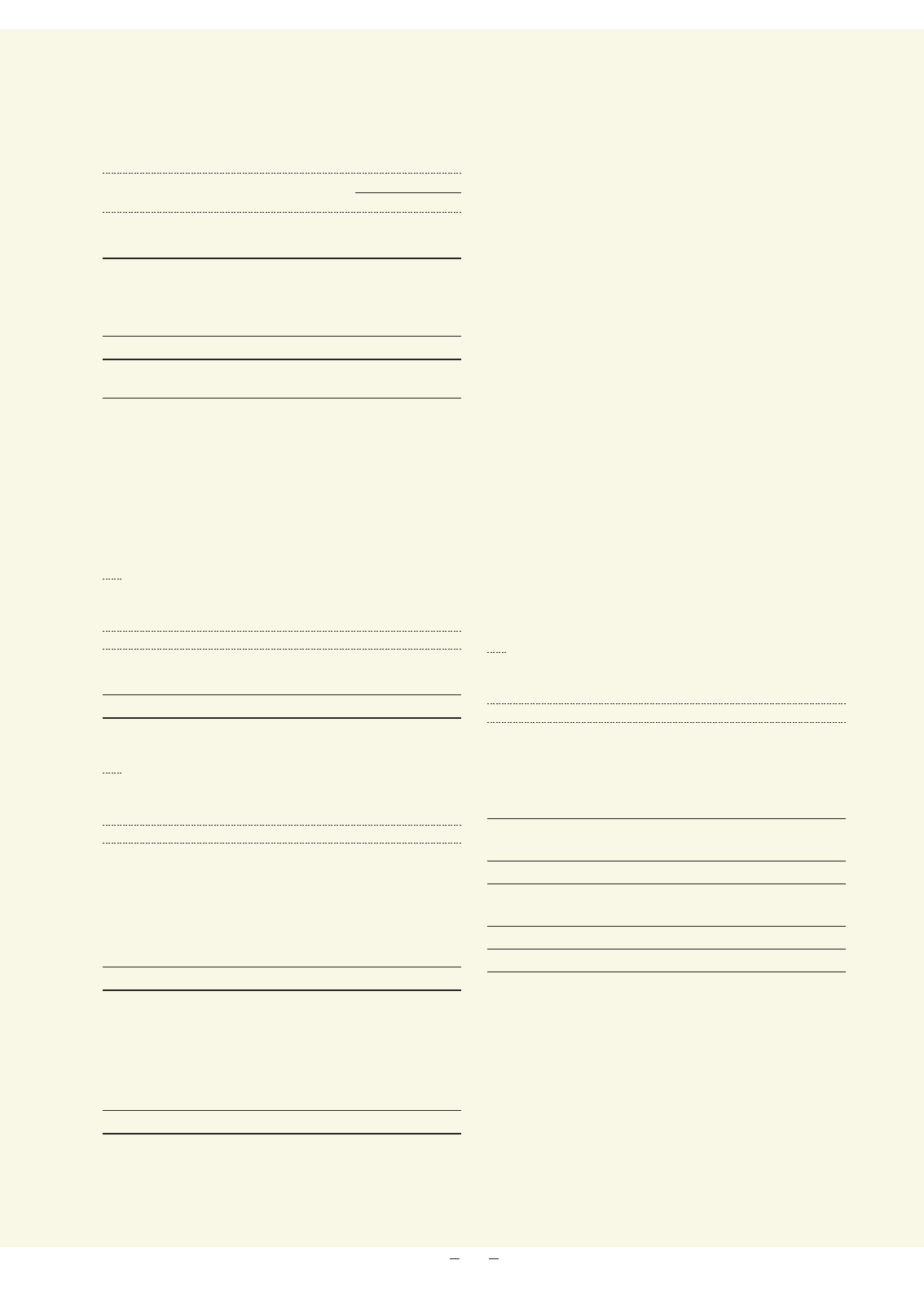

(dollars in millions)

FAIR VALUE

AT DECEMBER 31: 2003 2002

Marketable securities—current:

Time deposits and other obligations $«357 $«593

Marketable securities—non-current:**

Time deposits and other obligations $«««36 $«172

Non-U.S. government securities and

other fixed-term obligations 23 20

Total $«««59 $«192

Non-equity method alliance

investments** $«234 $«249

*Gross unrealized gains (before taxes) on marketable securities and alliance investments

were $11 million and $9 million at December 31, 2003 and 2002, respectively. Gross

unrealized losses (before taxes) on marketable securities and alliance investments were

$2 million and $10 million at December 31, 2003 and 2002, respectively. See note N,

“Stockholders’ Equity Activity,” on pages 100 and 101 for net change in unrealized

gains and losses on marketable securities and certain other information regarding

unrealized losses.

** Included within Investments and sundry assets in the Consolidated Statement of

Financial Position. See note H, “Investments and Sundry Assets,” on page 94.

E

inventories

(dollars in millions)

AT DECEMBER 31: 2003 2002

Finished goods $««««992 $««««960

Work in process and raw materials 1,950 2,188

Total $«2,942 $«3,148

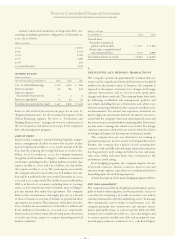

F

financing receivables

(dollars in millions)

AT DECEMBER 31: 2003 2002

Short-term:

Net investment in sales-type leases $«««5,940 $«««5,779

Commercial financing receivables 5,653 4,972

Customer loans receivable 5,235 4,462

Installment payment receivables 657 698

Other non-Global Financing related 98 85

Total $«17,583 $«15,996

Long-term:

Net investment in sales-type leases $«««6,010 $«««6,505

Commercial financing receivables 197 462

Customer loans receivable 4,300 4,179

Installment payment receivables 217 273

Other non-Global Financing related 17 21

Total $«10,741 $«11,440

Net investment in sales-type leases is for leases that relate

principally to IBM equipment and are generally for terms

ranging from two to five years. Net investment in sales-type

leases includes unguaranteed residual values of $845 million

and $821 million at December 31, 2003 and 2002, respectively,

and is reflected net of unearned income of $1,227 million and

$1,330 million and of allowance for uncollectible accounts of

$337 million and $361 million at those dates, respectively.

Scheduled maturities of minimum lease payments outstand-

ing at December 31, 2003, expressed as a percentage of the

total, are approximately as follows: 2004, 53 percent; 2005,

29 percent; 2006, 13 percent; 2007, 4 percent; and 2008 and

beyond, 1 percent.

Customer loans receivable are provided by Global

Financing to the company’s clients to finance the purchase

of the company’s software and services. Global Financing

is one of many sources of funding from which clients can

choose. Separate contractual relationships on these financing

arrangements are generally for terms ranging from one to

three years requiring straight-line payments over the term.

Each financing contract is priced independently at competi-

tive market rates. The company has a history of enforcing

the terms of these separate financing agreements.

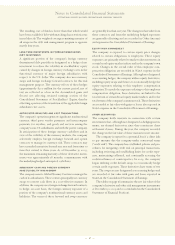

G

plant, rental machines and other property

(dollars in millions)

AT DECEMBER 31: 2003 2002

Land and land improvements $««««««865 $««««««837

Buildings and building

improvements 9,261 8,978

Plant, laboratory and

office equipment 22,317 21,416

32,443 31,231

Less: Accumulated depreciation 19,190 18,525

13,253 12,706

Rental machines 4,679 4,852

Less: Accumulated depreciation 3,243 3,118

1,436 1,734

Total $«14,689 $«14,440

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

93