IBM 2003 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2003 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

actions discussed in note S, “2002 Actions,” on pages 105

through 107 are also included in SG&A. The cost of internal

environmental protection programs that are preventive in

nature are expensed as incurred. The company accrues for all

known environmental liabilities when it becomes probable

that the company will incur cleanup costs and those costs

can be reasonably estimated. In addition, estimated envi-

ronmental costs that are associated with asset retirement

obligations (for example, the required removal and restoration

of chemical storage facilities and monitoring) are also accrued

when it is probable that the costs will be incurred and the

costs are reasonably estimable. The accounting for asset

retirement obligations (AROs) is further discussed below in

“Depreciation and Amortization.”

Research, Development and Engineering

Research, development and engineering (RD&E) costs are

expensed as incurred.

Intellectual Property and Custom Development Income

As part of the company’s ongoing business model and as a

result of the company’s ongoing investment in research and

development (R&D), the company licenses and sells the rights

to certain of its intellectual property (IP) including internally

developed patents, trade secrets and technological know-

how. Certain transfers of IP to third parties are licensing/

royalty-based fees and other transfers are transaction-based

sales and other transfers. Licensing/royalty-based fees

involve transfers in which the company earns the income

over time, or the amount of income is not fixed and deter-

minable until the licensee sells future related products (i.e.,

variable royalty, based upon licensee’s revenue). Sales and

other transfers typically include transfers of IP whereby the

company has fulfilled its obligations and the fee received is

fixed and determinable. The company also earns income from

certain custom development projects for specific clients.

The company records the income from these projects when

the fee is earned, is not refundable, and is not dependent

upon the success of the project.

Other (Income) and Expense

Other (income) and expense includes interest income (other

than from the company’s Global Financing business transac-

tions), gains and losses from securities and other investments,

realized gains and losses from certain real estate activity, and

foreign currency transaction gains and losses.

DEPRECIATION AND AMORTIZATION

Plant, rental machines and other property are carried at cost

and depreciated over their estimated useful lives using the

straight-line method. ARO liabilities are the estimated costs

associated with the retirement of long-lived assets for which

a legal or contractual obligation exists. These liabilities are

recorded at fair value and the carrying amount of the related

asset is increased by the same amount. These incremental

carrying amounts are depreciated over the useful life of the

related assets.

The estimated useful lives of depreciable properties gen-

erally are as follows: buildings, 50 years; building equipment,

20 years; land improvements, 20 years; plant, laboratory and

office equipment, 2 to 15 years; and computer equipment, 1.5

to 5 years.

Capitalized software costs incurred or acquired after tech-

nological feasibility are amortized over periods up to 3 years.

Capitalized costs for internal-use software are amortized on

a straight-line basis over 2 years. See “Software Costs” on

page 85 for additional information. Other intangible assets

are amortized for periods up to 7 years. See “Standards Imple-

mented” on page 88 for additional information on goodwill.

RETIREMENT-RELATED BENEFITS

See note W, “Retirement-Related Benefits,” on pages 110

to 117 for the company’s accounting policy for retirement-

related benefits.

STOCK-BASED COMPENSATION

The company applies Accounting Principles Board (APB)

Opinion No. 25, “Accounting for Stock Issued to Employees,”

and related Interpretations in accounting for its stock-based

compensation plans. Accordingly, the company records

expense for employee stock-based compensation plans equal

to the excess of the market price of the underlying IBM

shares at the date of grant over the exercise price of the

stock-related award, if any (known as the intrinsic value).

Generally, all employee stock options are issued with the

exercise price equal to the market price of the underlying

IBM shares at the grant date and therefore, no compensation

expense is recorded. In addition, no compensation expense

is recorded for purchases under the Employees Stock

Purchase Plan (ESPP) in accordance with APB Opinion

No. 25. This plan is described on page 110. The intrinsic value

of restricted stock units and certain other stock-based

compensation issued to employees as of the date of grant is

amortized to compensation expense over the vesting period.

To the extent there are performance criteria that could result

in an employee receiving more or less (including zero) shares

than the number of units granted, the unamortized liability

is marked to market during the performance period based

upon the intrinsic value at the end of each quarter.

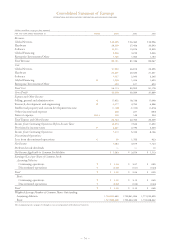

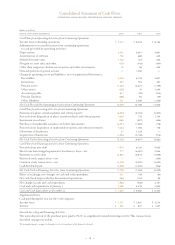

The following table summarizes the pro forma operating

results of the company had compensation cost for stock

options granted and for employee stock purchases under the

ESPP (see note V, “Stock-Based Compensation Plans,” on

pages 109 and 110) been determined in accordance with the

fair value-based method prescribed by Statement of Financial

Accounting Standards (SFAS) No. 123, “Accounting for Stock-

Based Compensation.”

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

82